The pandemic continues to challenge the supply chain in ways we didn’t expect. The Omicron variant has resulted in large numbers of staff being required to self-isolate either because of their own, or a family member’s infection. This scene has played out around the globe and has ultimately caused major disruption to freight and warehouse logistics. With downstream adverse effects on the supply of inventory to businesses, staff shortages have also caused disruptions to cash flow in the hospitality, leisure and gym sectors.

“The economic impacts of this near-global shut down because of the pandemic have thrust supply chain into the public realm in a way we have never seen before,” says David Paulson, global vice president at Avnet Inc in this edition of the Supply Chain Navigator.

Many businesses have been and will continue to be affected by these concerns – but don’t despair. There are strategies you can use to make sure your business stays in good shape. More on this later.

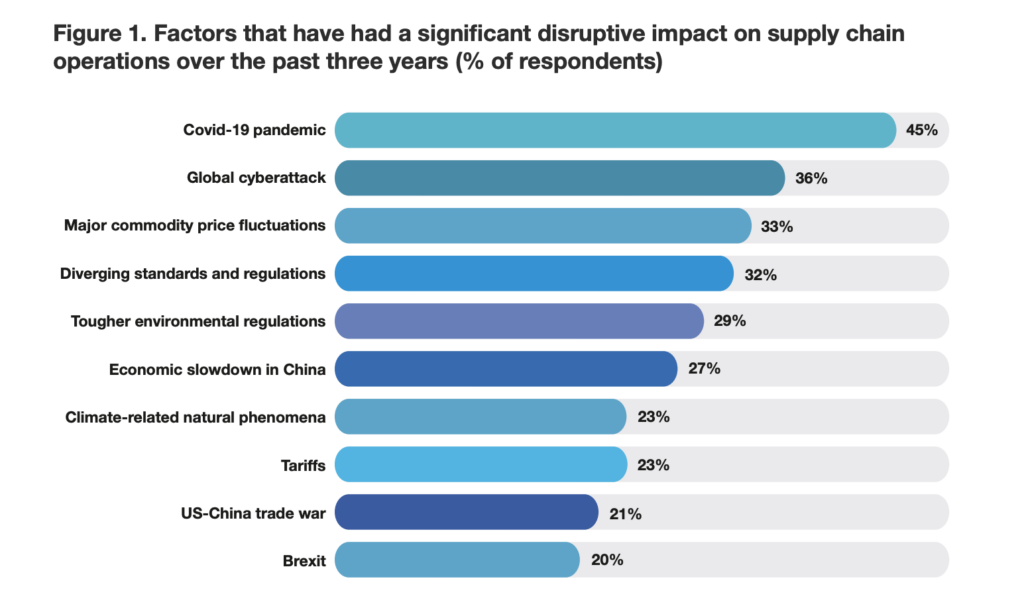

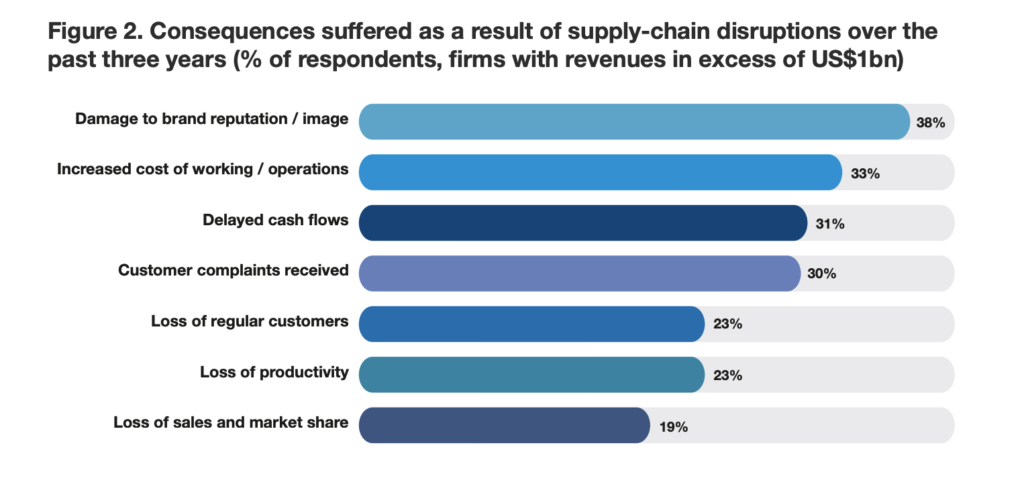

According to this report from The Economist, businesses have incurred substantial financial costs (averaging 6-10% of annual revenues) and reputational costs in terms of customer complaints and damage to brand reputation.

Image source: The Business Costs of Supply Chain Disruption

It’s likely that these impacts to businesses will continue to be felt for much of 2022 and possibly beyond. These include:

Image source: The Business Costs of Supply Chain Disruption

Businesses that take a range of actions to mitigate the impacts of future disruptions can turn the adverse effects into something positive.

Some strategies businesses can implement include:

Another strategy for businesses to recover is to extract cash and cost from the supply chain by changing the supply chain cost structure and working capital profile. This can be done by focusing on inventory rationalisation, procurement spend reduction, logistics and warehouse optimisation, and manufacturing productivity as explained in this survey by Ernst & Young LLP.

Although it’s an issue that’s not going to go away any time soon, the risks to your business of supply chain difficulties can always be lessened. Start by talking to your trusted accountant or adviser. Banjo is here to help, whether it’s a chat with one of our experienced credit assessment team members to talk through potential solutions, or an injection of funds to help get over this period, you can always reach us on 1300 22 65 65.

* Lannin, Sue. “Shipping cost surge raises retail price pressures and inflation risks.”10, June. 2021. https://www.abc.net.au/news/2021-06-10/prices-consumers-shipping-ports-trade/100203086

** Walh, Liam. “’Supply worsening’: 99 Bikes warns on global snags.” Financial Review. 3, jan, 2021. https://www.afr.com/companies/healthcare-and-fitness/supply-worsening-99-bikes-warns-on-global-snags-20201223-p56prh

Supply chain impacts on working capital have resulted in businesses carrying more inventory than historical levels to meet customer demands. This is having an adverse effect on their working Cash Conversion Cycle. Here’s a previous post we wrote about the early signs to look out for when managing your inventory levels.

Eric Gantier, President, Global Engineering, Manufacturing and Energy Sector, DHL, says that companies face three critical challenges over the coming months. They include:

“The pandemic caused a huge amount of disruption, with shortages of critical components or inventory stranded in the wrong places,” he says. “Right now, the supply chain is at the top of the agenda for our customers. That means supply chain leaders are under pressure to get things right, but they also have opportunities to make the changes that could transform their performance.”*

The Cash Conversion Cycle (CCC) tells a business owner the average number of days it takes to purchase inventory, and then convert it to cash.

The CCC time depends on how a company finances its purchases, how it allows customers to pay (credit and the collection period), and how long it takes to collect.

A lower CCC is an indicator of a faster inventory-to-sales process that is the time it takes a business to purchase stock and how long it takes to collect the money once a customer pays for it. In contrast, a higher CCC indicates a slower process.

Businesses have had to buy additional stock of inventory to meet the demands of their customers. As a result, their cash is tied up with unsold goods, putting pressure on the currently available funds to the business.

Businesses will continue to experience high inventory levels until the issues with the supply chain smooth out, which has been reported to be in 2023*. However, the positive news is that businesses can focus on other parts of their cash conversion cycle to improve their cash flow.

Debtor Days show the average number of days it takes a business to receive payment from customers for invoices issued to them. If you have a high number of debtor days, this means that your business has less cash, impacting other things your business could be investing in to grow.

Businesses can control the number of days it takes for debtors to pay their invoices by getting the debtor days back to normal. This streamlining may not always be possible, especially with very large retailers. However, trying to negotiate a reduction in your payment terms from 90 days to 45 days can hugely benefit your cash flow cycle. This will help businesses to achieve a more robust cash conversion cycle.

A higher or quicker inventory turnover decreases the cash conversion cycle. Thus, a better inventory turnover is a positive for the CCC and the business’s overall efficiency.

However, this will be challenging as we see more businesses sitting on their inventory due to supply chain issues.

Extending creditor days on hand from 30 days end of month to 45 days can provide your business with cashflow benefits. Review all your key creditors and identify those whereby your strong historical relationship could translate into more favourable terms for your business.

If you want to speak directly with a trusted and highly experienced credit assessor to discuss how a loan can help your cash conversion cycle, please call Banjo on 1300 22 65 65. Alternatively, please email customerservice@banjoloans.com

How do you know which finance option is best suited to your circumstances? To learn more about the main types of financing available to businesses, download a copy of Banjo’s free ebook.

* “Delivered. The Global Logistics Magazine.” Jan, 2021. https://www.dhl.com/content/dam/dhl/global/delivered/documents/pdf/dhl-delivered-issue-1-2021.pdf

There is a lot that had happened in the last seven months when we brought you our Economic Outlook Webinar. Banjo once again partnered with David Robertson, Head Economist from Bendigo Bank, and Patrick Coghlan, CEO of CreditorWatch, to bring you this session. This interactive and timely webinar highlighted the current state of the economy locally and globally and its impact on Australian businesses and households.

Despite going through one of the most significant shocks to the global economy, even worse than the GFC, Australia’s GDP fully recovered. However, we are now facing a W shaped recovery of the economy.

Hopefully, this means that 2022 will be a robust recovery period, despite the setbacks in Sydney and Melbourne. Also, putting aside the shared optimistic forecast for next year, it will be interesting to see how the economy responds to the $311 billion worth of stimulus in place from the Federal Government.

Some of the topics discussed included:

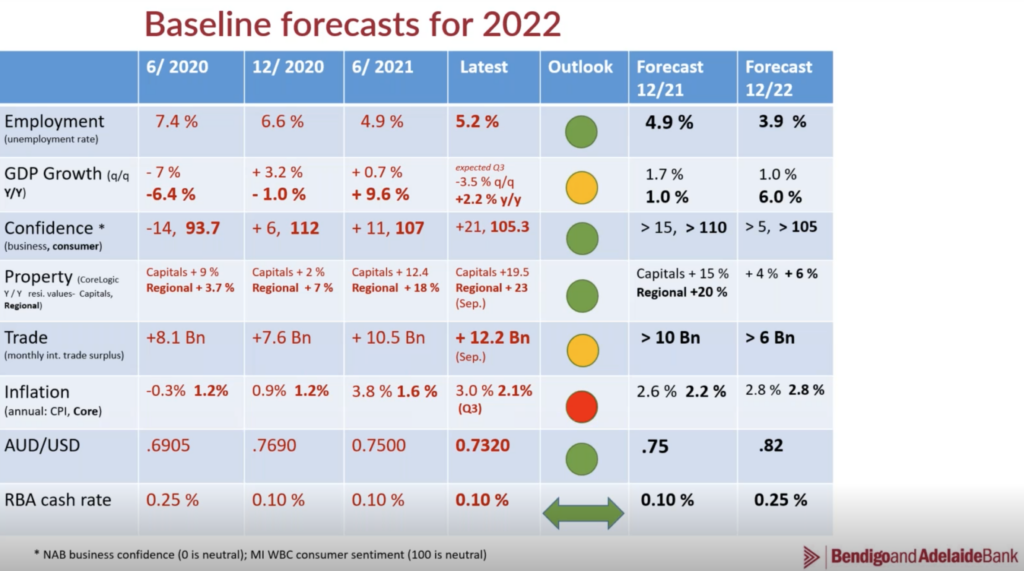

Before giving you a little taste of each topic below, here’s an interesting chart that looks at the baseline forecasts for 2022.

The baseline chart above illustrates that the unemployment rate will fall aggressively in 2022, leading to strong employment growth. The outlook for a strong GDP for 2022 (increasing to 6%) is due to the reopening of the economy and Australia’s high vaccination rates. In addition, Australia’s confidence levels have been resilient throughout the year. It’s also worth noting that the one area highlighted in red is inflation which David covers below.

Below are ten predictions for 2022 presented in the webinar by David.

1. Chinese economy decelerating but can manage a soft landing

2. COVID vaccines the key driver of the global recovery – EU well placed

3. Geopolitical tensions to bubble away- but ‘don’t bet against the USA’

4. Global reflation underway- technology explosion and infrastructure binge

5. Stock markets supported by low ‘risk-free rates’, but inflation and ESG focus to grow.

6. Australian economy to grow around 6 % in ’22; regional economies outperforming

7. National unemployment rate to trend down to 4 % in 2022

8. Aussie Dollar eventually back above 80 c (holding above 71 c)

9. Property to remain in demand but RBA rate hikes to impact in FY23

10. Commodity prices to remain elevated, exports to hold up resiliently.

It’s been the perfect storm for high inflation around the world. With sharp rises to core inflation due to the high cost of energy, import costs and oil. How will Australia respond to these global pressures? David suggests there will be gentle increases in interest rates in late 2022 which will gradually get to 1% in early 2023.

The out performances of regional compared to capital cities is a trend that will not change soon. In regional areas, property prices are up close to 25% in 12 months, and David explains that regional will continue to outperform capital cities. Another challenge is the rise of fixed interest rates.

With solid recoveries in the US, Australia ASX200 (our main index) went from 6000 a few years ago to 7,500. Compared to the US, where the NASDAQ has grown from 16 points to 16,000 points! Australia has lagged due to a lack of innovation, something that needs to be improved.

Customer sentiment continues to be strong into 2022. However, how other states will localise their outbreaks once borders open to NSW and Victoria will be challenging. Business confidence will become strong at the end of the year, and business investment will pick up.

We hope you enjoyed reading this small snapshot of the key takeaways from Banjo’s Economic Outlook Webinar. If you are interested in hearing the entire webinar, feel free to drop us an email at info@banjoloans.com Also, don’t forget to follow Banjo’s LinkedIn company page for updates on our future webinars.

SMEs have evolved and pivoted to stay competitive despite the uncertainty and challenges of 2021. Many have embraced the ever-changing retail environment by investing in new markets and technologies, launching new products, and revisiting their strategy.

According to Business Insider Australia, Australian shoppers are gearing up to spend $11 billion on Christmas gifts. SMEs investing in their growth early on will come out on top during what may be one of the busiest retail periods we have seen in a long time. It is worth noting that this consumer demand is also reflected in the international market. The hope is that as the economy picks up momentum, it will rebound once businesses reopen in line with the states’ roadmaps.

With unemployment at its lowest since 2010* and the high cost of labour, expanding your team now may put your business’ shopfront and online presence in a stronger position during the festive season.

The predictions are that revenue will hit record levels in the December quarter. Retailers may also be forced to increase their headcount to keep up with customers’ demands for faster delivery options and safer, more efficient in-store experiences.

Don’t miss out on a much-needed sale. Increasing staff members can support your business. It can do this by offering a more personalised, convenient, and frictionless experience that your customers are looking to mimic at home and in-store.

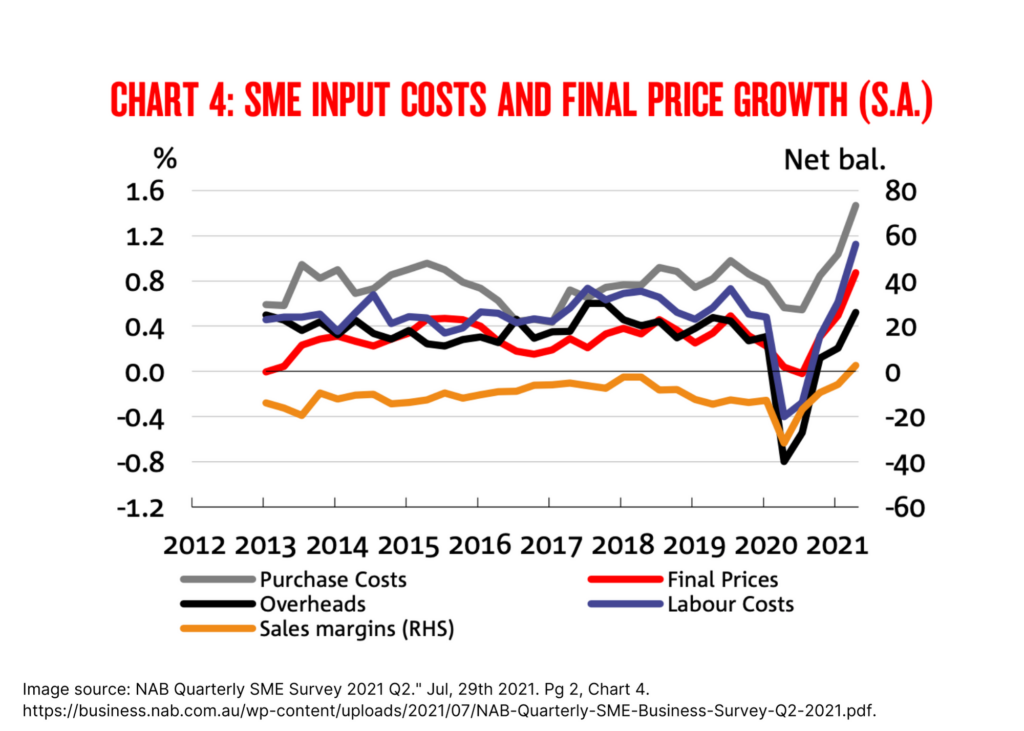

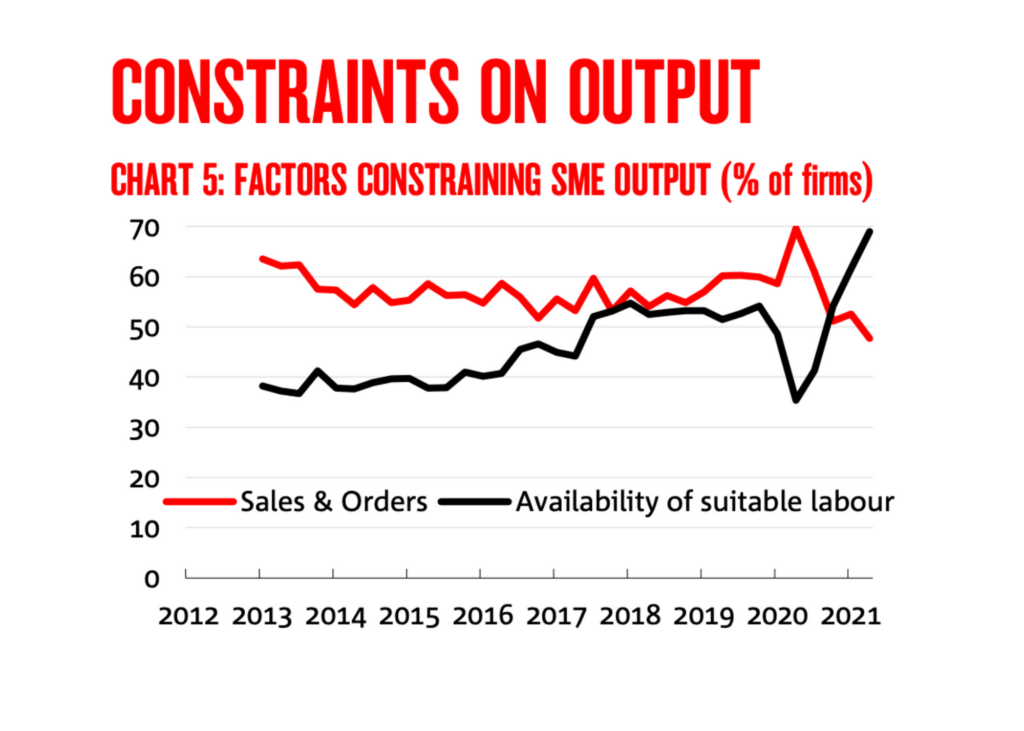

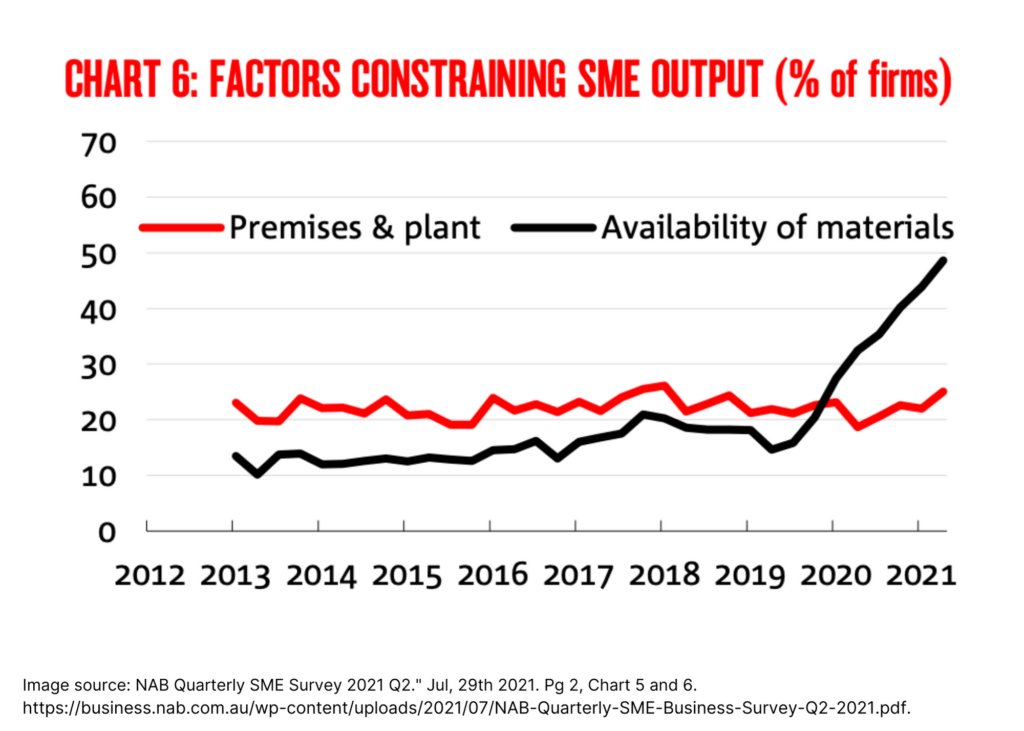

For the first time, the availability of materials is a larger issue than sales and orders.** With the pandemic still heavily impacting supply chains, sourcing stock and materials continue to be challenging. Supply shortages and distribution delays have been widely reported, and these are expected to last through the holidays and well into next year.

Even as the economy fully reopens and returns to some form of normality, supply chains will continue to be impacted by backlogs and increased demand. This could continue to mean you experience issues with inconsistent supply and other costs, such as warehousing and transportation. Therefore, to make sure your business keeps up with the increased demand this holiday season, you may need more additional stock upfront this year.

As the demand for online and instore increases, so will the push on your marketing budget. How are you planning to stand out from the crowd, ensuring your business’ physical shop front and online store are the first choice for customers looking to buy now? Increased awareness will be the key in generating growth, which retailers desperately need these holidays to combat the revenue lost due to lockdowns.

Margins remain tight due to increased expenses. However, this means that retailers do not have to go on sale earlier to sell down their stock. Resulting in business’ relying on amplifying their brand awareness. Examples include increasing your advertising budget across paid ads in Google, social media and even giving a little boost to your affiliate marketing. You may also like to boost your sales by offline retail tactics such as mailbox drops and radio advertising.

Christmas can be one of the busiest sale periods for your business. It’s also the period where your retail business may find it the most challenging. This is due to the decline in sales after Boxing Day up until February. Funding can help to alleviate stress and assist you with executing and running a more successful Christmas campaign without worrying about your cash flow.

The retailers we deal with that have innovated and capitalised on new and evolving trends. As well as delighting and pleasing their customers, are the retailers likely to get through these peaks and troughs this festive season.

Are you looking for quick decisions and want to talk to someone who genuinely cares about powering your growth? Get in touch today with one of our highly experienced and friendly credit assessment team members on 1300 226 565.

*Gray, David. “Vital Signs: 4.6% unemployment rate hints at what’s possible, but it’s not the real thing.” The Conversation, Aug, 19th 2021. https://indaily.com.au/news/business/2021/08/23/the-record-low-unemployment-rate-hints-at-whats-possible-but-its-not-the-real-thing/.

** “NAB Quarterly SME Survey 2021 Q2.” Jul, 29th 2021. https://business.nab.com.au/wp-content/uploads/2021/07/NAB-Quarterly-SME-Business-Survey-Q2-2021.pdf.

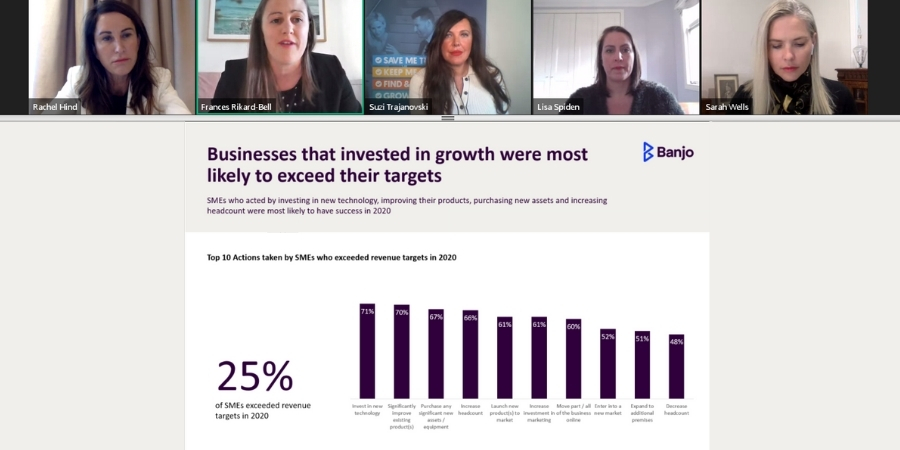

Last month, Banjo hosted a female-led panel discussion featuring a broad range of entrepreneurs. The webinar was part of a series organised in line with the release of this year’s annual Banjo SME Compass report.

The panel included the following successful leaders:

In this post, we share the experience of each leader being forced to adjust what they were doing in their businesses to pivot, adapt, and succeed during COVID.

Question 1. What are some of the key investments you are making in your business to continue to stay competitive in the current landscape?

Suzi – Some key investments we are making at Loan Market is the investment of hiring new developers and IT specialists to support the expansion of our online platform to ensure it aligns closely with our customers’ expectations. So, I would have to say tech and people have been our most significant investments in the organisations.

However, we also purchased three aggregators earlier this year for the mortgage broker space. Again, this shows how serious we are about the industry and our desire to see the industry evolve.

There was also a massive growth in staffing with the addition of 600 clients service managers. This means brokers grew their business because they had access to see their clients on zoom and transaction with them digitally. We also saw a spike of 37% in female business owners. It’s exciting to see more women taking a risk and going out on their own.

Sarah – The investment in human capital is an area I’m advising my clients to focus on. Investing in keeping people happy is vital, so they remain loyal and stay with the business. I’m also seeing my clients invest time in their strategic planning to see how they can disrupt the market after COVID. It will be interesting to see the growth experiences of those organisations that have stayed with their current service and product offering in the next 24-48 months.

Rachel – We cut our costs dramatically by trying to enter new markets, like Singapore and UK, to offer advisory and funding services. I saw an opportunity to expand to Singapore after seeing many senior roles being placed in Singapore. Establishing myself in Singapore has also allowed me to work closely with the Australian High Commission, ex-pats and start-ups looking to fund their business.

Lisa – Over the last two years, 50% of my clients are thriving and becoming super-efficient while the other 50% are struggling. Many clients are coming to us about staff burnout. So, I want to see how businesses will support their staff (one of their most important asset) because it will impact the businesses financially.

Question 2. If you trade online, what are some initiatives you are working on to ensure your online presence continues to play a key component of your growth strategy?

Lisa – My two businesses, fibreHR and Roster Right, are very different. FibreHR doesn’t require a huge online presence from a marketing perspective as most of our clients are via referrals. The other business, Pay Review, has some presence online, but if people have underpayment issues, they don’t Google the issues; instead, people turn to their advisors or accountants for help.

Roster Right is a new product and helps businesses to optimise their rosters. I have invested with an agency for lead generation led marketing activities to allow clients to find us easier in Google which will increase Roster Right’s online presence. Over the last few months, I’ve put a strategy to help better understand the customers, their buying patterns, and the best ways to meets those requirements.

Question 3. What are doing as a successful business leader to keep a strategic mindset during the operational challenges that COVID is causing?

Sarah – From a personal perspective, I feel that there are not enough hours in the day. The challenge for advisors and financial services is that we charge per hour. I’m also trying to prioritise finding work to ensure I have personal fulfilment. So, the balance I’m trying to find includes what work I enjoy, what is profitable, and what work will make the most impact.

It’s also very difficult in a debt space to see what that long term strategic plan looks like. For instance, we are in a low-interest rate environment with cheap capital. How will I grow now and pay that off in 2025? How can I grow now to ensure my business model is there post COVID?

Suzi – COVID has been a real leveller for women because it has helped women be more flexible. Common barriers and discussions with females starting their own mortgage broking business includes the thoughts they are having if entering motherhood. How will this affect their newly created businesses? It’s crazy that we are still discussing this in 2021, and it’s still a big discussion point for women wanting to start their brokerage business.

Question 4. As a woman in finance, what is a recent challenge you have had, and how did you overcome it?

Rachel – I’m on a mission to help SMEs with a desire to keep owners and lenders more connected. After a recent event I organised called “Seek 28 SMS in 28 days’’ an event connecting lenders and SMEs, I was astonished that 75% of SMEs did not know whom to go to for funding outside of banks. Some SMEs don’t have the cash flow for over 20 days, and with the government only doing so much, the grant system is hard to navigate and isn’t quick enough. So, to continue to try and get that message out there to connect SMEs with lenders.

Question 5. What would you do differently?

Lisa – At the beginning, I wasn’t aware I could get funding. One of my businesses has a safe and secure funding stream. But the other one is tech-heavy and required a heavy investment in tech. So, funding for that business was a lot harder. It would have helped if I knew that earlier. Every cash flow formula is different. So, my advice is to know how your business is eligible for funding and set up for success

Sarah – How to keep your stakeholders happy while navigating COVID. Business leaders imagine a life post COVID. How can the products we offer be better and more competitive over our competition?

Suzi – Brokers need to change the way they do business. I am seeing a shift in how to nurture my existing clients better instead of getting new clients.

We hope you enjoyed this write up featuring some very successful and strong female leaders in the industry. We look forward to sharing more insights into our future webinars here on our blog. For the latest on our webinars, be sure to check out our LinkedIn page.

In this M&A blog post, we look at funding an acquisition. But first, a quick recap of part one, where we talked about the different stages to consider when acquiring a business.

1. Research and Planning – Finding the right business

2. Evaluating the business – Determining the purchase price

3. Due Diligence – Normally the most detailed, highly confidential, and time-consuming stage.

4. Negotiating the contract

5. Settlement and Exit

Different ways to fund a merger or acquisition

Now we’ll look at different ways you can fund a merger or an acquisition. Each funding method comes with its own commitments, and risks, so it’s important to do your due diligence to ensure the best type of funding for your circumstances.

Large businesses have often built up enough equity in their balance sheets to leverage off, but this would be quite rare in small to medium businesses. As an SME owner, you’d typically look at debt funding to acquire another business.

To fund your acquisition, you’re most likely to use one or more of four longer-term finance options: term loans; vendor finance; equity financing; and sale on leaseback.

1.Debtor Finance – This type of finance is provided as a loan and is secured against the value of outstanding invoices on a business’s accounts receivable ledger, unlike term loans that require security over personal assets to provide funds. This is widely used to fund a range of business needs, turning unpaid invoices into working capital. In addition, debtor finance helps post-funding day-to-day operations as it is a way to cover the cash flow gaps caused by extended payment terms and late-paying customers.

Two key advantages of funding via debt are:

2.Bank Overdraft – An overdraft allows you to continue spending or withdrawing money even though your bank account balance has reached zero. In other words, an overdraft allows your bank account to have a negative balance. Overdrafts can offer a business great flexibility and peace of mind, providing access to funds but with no fixed term or repayment schedule. Overdrafts might be easier to obtain than a term loan from a bank but the downside is that they can attract interest, fees and charges.

3.Term Loans – A term loan is a fixed amount of money lent to you for a set repayment schedule over a specific period. There are various lenders you can approach to get term loans, such as banks and alternative lenders. When traditional lenders such as banks offer this form of finance, they usually require you to provide security over your commercial and/or personal assets. The terms are often not very flexible, and it can take several weeks and sometimes months for the loan to be approved or declined.

A term loan from an alternative lender such as Banjo allows you to access the funding you need with quick decisions and funds being available in your bank account in as little as 48 hours. Banjo can fund up to $500K via a term loan and has helped a wide range of businesses to fund their acquisitions in this way.

Here is an example of how Banjo helped to fund a recent acquisition deal:

Client case study – Petrol station:

The client, who already owned a petrol station, wanted to acquire a second one.

Banjo reviewed the deal by combining the numbers from both the petrol stations. As a result, both the petrol stations were profitable and required the owner to contribute 40% of equity to finalise the deal.

Banjo funded $1,000,000 million across both businesses, with the remaining amount provided by the client. The deal was settled within 5 days from the time client started their loan application process.

4. Sale on Leaseback – If you’re acquiring a company that has unencumbered plant machinery equipment on its balance sheet, you can approach a specialised asset financier to make a sale on leaseback on that equipment.

Under this arrangement, you would sell the plant machinery (the asset) to the asset financier, who would then lease the machinery back to you. You can continue to use the keep the machinery at your business premises by paying the financer a set fee until the time you have fully repaid the financer.

At Banjo, we’ve seen a few businesses fund acquisitions using this method. Having shown us the valuation of the target company, they’ve been able to raise substantial funds via sales on leaseback from the unencumbered assets in the balance sheet.

5. Vendor finance – When the existing owners finance part of the purchase. But they will typically either keep percentage equity of charge interest of whatever they are giving the purchaser to see how they work. This is one funding option that can be used in conjunction with Banjo.

If you are looking to expand your business and need to discuss funding options for your future merger or acquisition, please feel free to contact us via email at customerservice@banjoloans.com Or get in touch directly with one of our credit assessment team members on 1300 22 6565.

At Banjo, we’ve recently seen an uplift in business purchase enquiries. There is a lot of activity compared to previous years, with unfortunately many family-owned and private SMEs struggling, looking to get out as they may not recover. This presents opportunities for a competitor looking to expand and safeguard their business by acquiring another company at potentially a much lower price. Banjo has also noticed two industries that stand out with more enquiries made include the hospitality (cafés) and retail (petrol stations) sectors.

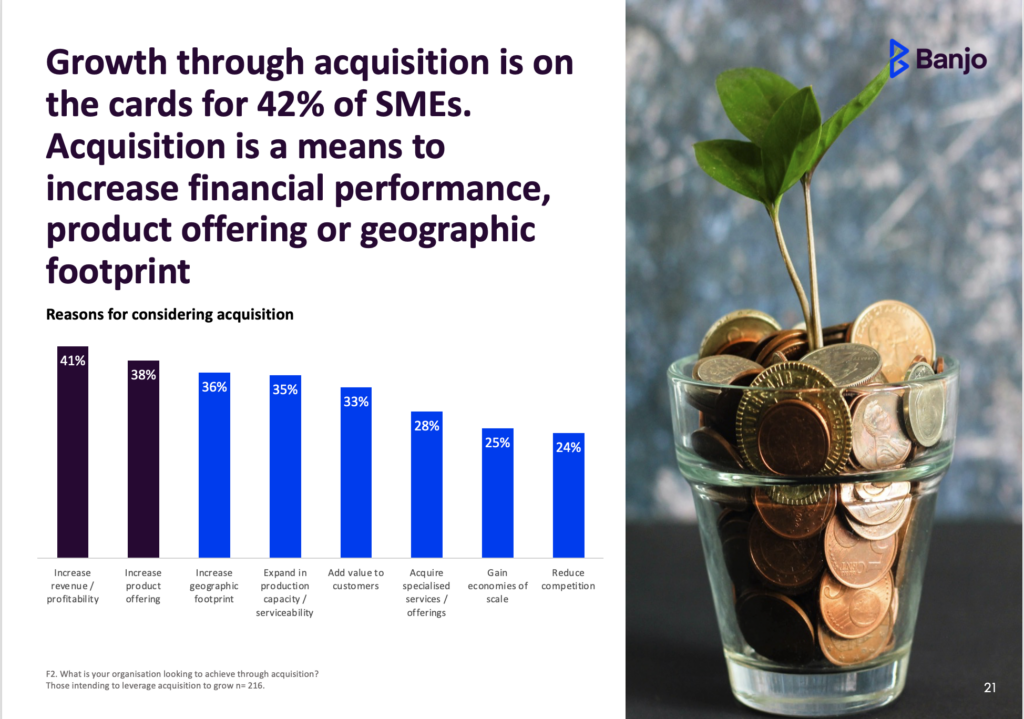

With the recently commissioned annual research surveying a large cross-section of Australian SMEs, Banjo’s SME Compass report found that 42% of the SMEs are currently growing* via acquisition, or they are thinking about it. This figure illustrates the desire for SMEs to grow their financial performance, product offering or geographic footprint*.

The different stages of an acquisition

There is a process SMEs need to go through before acquiring a business. The method includes making sure to do the planning, research, and due diligence earlier on, so all the details of a business’s health and position are known. SMEs can then put themselves in a more advantageous position when inheriting the business from the previous owner and ensuring it will continue to trade strong and be successful.

Below are some of the different stages to consider when acquiring a business.

One of the first steps in acquiring a suitable business is to register with as many business brokers as possible. This will ensure you are presented with relevant new, established or franchisee business opportunities available to purchase.

There are many ways a deal can occur once the acquisition of a business is decided, and here are some questions to consider:

These initial questions should be directed to experts such as your accountant, business advisor and lawyer who can guide you through the process and advise how to best structure the deal.

This upfront advice is valuable as it allows you to talk through the different scenarios from a conservative and creative perspective.

Deciding the current market value of a business isn’t straightforward. For example, what will be the sale price, and what does the purchase price include? A lot of the time, Banjo observes deals where the business is doing well and is profitable, but it doesn’t always include the equipment and stock. You’re probably going to need it independently valued so things such as the finance and assets of the business as well as legal and business information can be evaluated.

The valuation will also consider whether the sale is a forced one; for instance, due to unforeseen circumstances such as COVID, does the owner need to sell the business in a hurry? Your accountant should also assist you with understanding the value of the tangible or intangible assets of the business. This includes understanding the value of the assets you can see versus the value of the business’s reputation, customer base etc., which can be a bit tricky to calculate on your own.

If you lean on your experts to assist you during this stage, be aware that they may use one of the many different methods to evaluate the purchase price.

This stage is completed after you have verbally agreed to the sale before signing any contracts. So, it’s best to be convinced at this stage that you are likely to proceed with the deal as this stage can be costly and, depending on the complexity of the business, can take anywhere from a week or two to several months.

The due diligence is carried out to ensure the business’s valuation is correct and that you understand all the risks and liabilities involved with the purchase. It’s also an opportunity to ask the tough questions and obtain as much information as possible, which can ultimately make the transition into your newly acquired business a smoother experience.

Some main areas of due diligence include collecting, analysing, and reviewing the commercial, financial, and legal details of the business you are looking to acquire.

Your lawyer or another financial expert should have a comprehensive checklist that dives deep into these areas to ensure all the relevant and important information is obtained from the vendor.

All contract negotiations should be handled through a lawyer after the due diligence, and the value of the business is finalised. Once you and the seller have agreed on the sale, your solicitor should draw up a legal contract specifying the sale details so you can present a formal offer, the buyer to the seller of the business you have acquired.

It’s also important to point out that before any formal offer can be presented, you should have already spoken to your financier to understand your funding requirements.

Planning and finalising the transition to the new owner is usually done promptly. However, it’s also a good idea to decide how this transition and change will be communicated to all of those involved in the business, such as the staff, partners, suppliers etc.

Stay tuned for part two where we go into the details of different ways to fund a merger or acquisition. As well as include scenarios of how Banjo was able to fund different acquisition deals for our clients.

*Page 20 – Growth through acquisition is on the cards for 42%* of SMEs as acquisition is seen to be a means to increase financial performance, product offering or geographic footprint

SMEs are increasingly using the services of commercial finance brokers to secure a business loan.

While there are fewer female commercial finance brokers than male ones, many of the women have years of experience in the industry, and in working with hundreds of SME clients. However, they have sometimes flown under the radar in terms of their profile. That is now changing.

Yasmine Shah, Relationship Executive at Tradeplus 24, founded The Women’s Commercial Finance Forum (WCFF) in February 2020 to address this. Yasmine wanted to provide a community for women brokers to connect, share ideas, knowledge, and best practice with each other to propel themselves and their SME clientele further towards success in a highly competitive and complex finance environment.

Currently hosted on Facebook, the group has grown from 2 to over 570 members in just 13 months, bringing together female brokers of all levels of skill and experience in the commercial finance sector.

Yasmine believes that more women joining the commercial finance industry, will bring better options for SMEs, and a greater diversity of opinions and perspectives.

“The female brokers I meet are so incredibly passionate, talented and driven. They’re kicking goals for their clients, and delivering strong value.”

“All SME owners are on a mission to deliver their dream and want to understand how engaging finance will help them to do that. Brokers ask the hard questions, challenge lenders and negotiate on behalf of their clients to get them a better deal,” Yasmine said.

“The skill and confidence required to achieve these come not only from experience, but also from good empathy which is a particular strength in women brokers.”

Yasmine’s advice to SMEs thinking about engaging finance for their business is to ask yourself these questions, then speak to a broker:

Working with a broker helps you uncover what you may not know and to protect yourself and your business in the process.

For example, if you need a $50,000 business credit line your broker may organise this for you.

“They’ll also enquire about your medium to long term cash flow needs and put relevant products in place for you that won’t have a heavy impact on your cash flow and at the least possible cost,” Yasmine explains.

This ensures that your working capital needs are met and you can focus on growing your business with peace of mind.

Finally, be wary of shopping around too much, as there’s a large opportunity cost for not acting now.

Sonja Pfitz from Pfitz Financial & Business Solutions is a commercial finance broker for SMEs, specializing in local and global funding solutions for manufacturers. Her 25+ year career in finance and in the ownership of various businesses has provided her with first-hand experience, and insights into the funding challenges faced by manufacturing companies.

Sonja’s clients have included a wide range of small to large companies in the steel, plastics, defence, food & beverage, chemicals and medical sectors.

Sonja’s advice for SMEs in the manufacturing business is “Own your vision with passion and transparency. Be wise in surrounding yourself with specialists in their field to support you and the growth of your business.

“Never take a setback or not winning a client as defeat or failure – it’s a challenge that will make you even more successful, from the lessons you have learned. Most of all take time to look after yourself… a healthy mind & body, is a happy effective business person.”

Cashflow is the lifeblood of our businesses. With some of the government coronavirus business packages set to end or start phasing out – most notably JobKeeper – now more than ever is the time to plan and manage your cashflow before we reach the “stimulus cliff”.

Lance Rubin CEO and Founder of Model Citizn joined a Banjo webinar recently to talk about how cash flow analysis can help SMEs make better decisions for the future of their business.

Lance explained that cashflow modelling is a process of designing and constructing a decision-making tool for the various scenarios that can impact your business.

Also known as scenario analysis, it can help you plan mathematically for business risks and see what the cashflow outcome would be. Scenario planning is about looking forward, not backwards, using numbers.

Some typical scenarios could include what happens if:

It also helps you pinpoint if you have a sensitivity to one particular variable in your business, for example: staffing levels, or one large debtor.

Do you know how long your current cash reserves will last?

What impact will JobKeeper tapering off over the next 6 months have on your business?

Will you be affected when some of the other stimulus measures end?

In the light of this consider what are your business options now, and what might those look like if you did something different. It could be pivoting your business to a new market, reducing staff hours or numbers, or sourcing materials offshore. You can play with the different scenarios, and while not all of them will work for you, it will give you ideas and choices. It’s good to have options.

Having the ability to play with this is key. However, it does need to be well set up in the first place. You can use a variety of tools on the market, or simply start with a spreadsheet. Various types of cashflow analysis can be produced from the information you already have, such as: income statement; balance sheet; cash flow statement.

Lance demonstrated via live charts the effect on the cash flow position of pulling various business levers. If we make changes to ‘x’ or ‘y’, what impact will that have on our cash?

Ideally, work with your accountant, who can help with the compliance and legal knowledge. Most importantly, know what you want to find out from this. Start with your historical cash flow; look at your profitability; get it all put in a spreadsheet that you can change.

This could be vital if you’re looking to borrow or top up your loan. Traditional lenders often just look at historical data, which is only an insight into the past. While many of the new wave of business lenders do take into account past data, they also place a strong focus on future cashflow analysis. This will also be true of other stakeholders in your business.

Being able to explore potential scenarios will help to reduce uncertainty you may feel about the coming months as you navigate the changed business environment. While nothing can provide complete certainty, cashflow modelling can help reduce anxiety about the future.