At Banjo, we've recently seen an uplift in business purchase enquiries. There is a lot of activity compared to previous years, with unfortunately many family-owned and private SMEs struggling, looking to get out as they may not recover. This presents opportunities for a competitor looking to expand and safeguard their business by acquiring another company at potentially a much lower price. Banjo has also noticed two industries that stand out with more enquiries made include the hospitality (cafés) and retail (petrol stations) sectors.

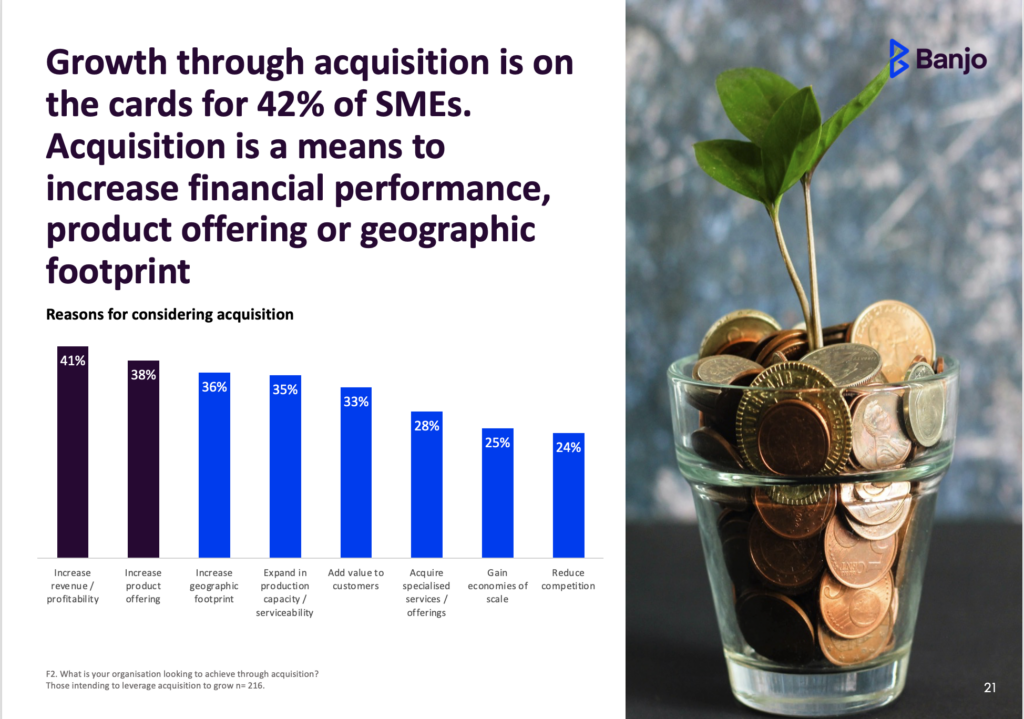

With the recently commissioned annual research surveying a large cross-section of Australian SMEs, Banjo's SME Compass report found that 42% of the SMEs are currently growing* via acquisition, or they are thinking about it. This figure illustrates the desire for SMEs to grow their financial performance, product offering or geographic footprint*.

The different stages of an acquisition

There is a process SMEs need to go through before acquiring a business. The method includes making sure to do the planning, research, and due diligence earlier on, so all the details of a business's health and position are known. SMEs can then put themselves in a more advantageous position when inheriting the business from the previous owner and ensuring it will continue to trade strong and be successful.

Below are some of the different stages to consider when acquiring a business.

1. Research and Planning – Finding the right business

One of the first steps in acquiring a suitable business is to register with as many business brokers as possible. This will ensure you are presented with relevant new, established or franchisee business opportunities available to purchase.

There are many ways a deal can occur once the acquisition of a business is decided, and here are some questions to consider:

- How much available cash \ equity is available in your business?

- How will you fund the remaining balance required to finalise the acquisition?

- Who will you go to for legal and financial advice regarding the transaction?

- How will you merge the two businesses, and what will the business's ongoing operations look like?

- Do you have enough experience to acquire this business if it's in a different industry?

- Is the location ideal? Does the location align with your geographic goals?

- Are you familiar with the business's customer base and market operations?

- How is the business positioned in the marketplace?

- How will new technologies impact the business?

These initial questions should be directed to experts such as your accountant, business advisor and lawyer who can guide you through the process and advise how to best structure the deal.

This upfront advice is valuable as it allows you to talk through the different scenarios from a conservative and creative perspective.

2. Evaluating the business - Determining the purchase price

Deciding the current market value of a business isn't straightforward. For example, what will be the sale price, and what does the purchase price include? A lot of the time, Banjo observes deals where the business is doing well and is profitable, but it doesn't always include the equipment and stock. You're probably going to need it independently valued so things such as the finance and assets of the business as well as legal and business information can be evaluated.

The valuation will also consider whether the sale is a forced one; for instance, due to unforeseen circumstances such as COVID, does the owner need to sell the business in a hurry? Your accountant should also assist you with understanding the value of the tangible or intangible assets of the business. This includes understanding the value of the assets you can see versus the value of the business's reputation, customer base etc., which can be a bit tricky to calculate on your own.

If you lean on your experts to assist you during this stage, be aware that they may use one of the many different methods to evaluate the purchase price.

3. Due Diligence – Normally the most detailed, highly confidential, and time-consuming stage.

This stage is completed after you have verbally agreed to the sale before signing any contracts. So, it's best to be convinced at this stage that you are likely to proceed with the deal as this stage can be costly and, depending on the complexity of the business, can take anywhere from a week or two to several months.

The due diligence is carried out to ensure the business's valuation is correct and that you understand all the risks and liabilities involved with the purchase. It's also an opportunity to ask the tough questions and obtain as much information as possible, which can ultimately make the transition into your newly acquired business a smoother experience.

Some main areas of due diligence include collecting, analysing, and reviewing the commercial, financial, and legal details of the business you are looking to acquire.

Your lawyer or another financial expert should have a comprehensive checklist that dives deep into these areas to ensure all the relevant and important information is obtained from the vendor.

4. Negotiating the contract

All contract negotiations should be handled through a lawyer after the due diligence, and the value of the business is finalised. Once you and the seller have agreed on the sale, your solicitor should draw up a legal contract specifying the sale details so you can present a formal offer, the buyer to the seller of the business you have acquired.

It's also important to point out that before any formal offer can be presented, you should have already spoken to your financier to understand your funding requirements.

5. Settlement and Exit

Planning and finalising the transition to the new owner is usually done promptly. However, it's also a good idea to decide how this transition and change will be communicated to all of those involved in the business, such as the staff, partners, suppliers etc.

Stay tuned for part two where we go into the details of different ways to fund a merger or acquisition. As well as include scenarios of how Banjo was able to fund different acquisition deals for our clients.

*Page 20 – Growth through acquisition is on the cards for 42%* of SMEs as acquisition is seen to be a means to increase financial performance, product offering or geographic footprint