The Australian economy is currently facing some potential challenges, including inflation, wages growth and an anticipated rise in interest rates. In this edition of Business Wrap, we look at the flow-on effect to businesses and households.

Included is our conversation with the Australian Steel Institute Chief Executive, Mark Cain who explains the effects these microeconomic issues are having on his members.

Inflation and wages

Many factors can cause inflation. The most common is companies passing their increased costs of production and distribution of goods and services onto consumers. In a recent Business Wrap, we talked about how persistent disruptions to supply chains and distribution networks are having a flow-on effect on costs globally, causing a heightened level of uncertainty.

Australia is also now experiencing wages pressure – more on this below.

- There’s a convergence of factors squeezing the cost of goods and services at the moment. The price of crude oil is at a multi-year high, in part due to increased demand as economies around the world re-start post COVID. Other factors include the geopolitical tensions between Russia and Ukraine. The result is petrol prices have risen for the sixth consecutive quarter, with many Australians paying up to a record $2 per litre at the bowser in recent weeks. This has a flow-on effect on transport, distribution and other costs, which contributes to inflation.

- Building materials – Master Builders Victoria continues to voice their concerns with news that Australia is facing its worst materials shortage in more than 40 years. Master Builders CEO Rebecca Casson said one of the biggest challenges Victorian building and construction companies faced was escalating building product prices and supply shortages. With the average cost of supplies used in home building rising 8 per cent on average across Australian cities. Some builders are having to pay a premium for materials if they need them sooner

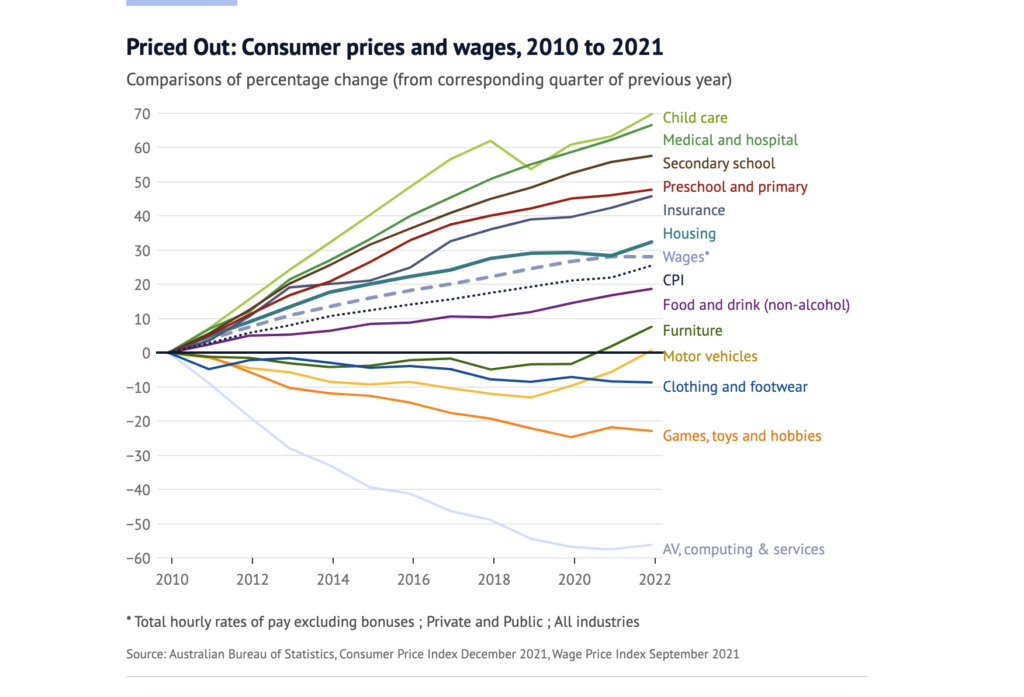

- Goods and services – prices of everyday items have increased (see ABS graph below). The CEO of Coles recently warned that, for the first time in a long while, strong inflationary pressures are going to make the cost of a weekly grocery shop more expensive.

For more information check out the Australian Bureau of Statistics figures.

Inflation in itself is not necessarily unhealthy, but it becomes a problem when it goes on for a prolonged period and wages don’t grow at the same rate – diminishing the buying power of consumers.

With inflation rising to 3.5 per cent in the December quarter, the Reserve Bank of Australia (RBA) is keen to see wages rise as well.

Reduced immigration of skilled workers to Australia due to COVID has created a tight labour market. Employers are under pressure to increase wages to stay competitive and attract qualified talent in a limited resource pool.

Unions are starting to push for 3 per cent annual pay rises in wage negotiations. While recent data from the December quarter showed that wages were starting to rise, those increases are not keeping up with inflation. The February ABS wage price index indicates that annual wages growth is at 2.3 per cent versus the inflation rate of 3.5 per cent.

According to the ABS data, real wages have fallen by 0.8 per cent since 2019, the first time this has happened since the turn of the century.

The Australian Chamber of Commerce and Industry Chief Executive Andrew McKellar has called for improvements to Australia’s productivity and economic efficiency, stating that until that happens, “we won’t see the stable and sustainable increase to wages the community expects.”

The Productivity Commission’s 2017 recommendations for boosting productivity - which include a wide range of measures like an overhaul of intellectual property laws, road user charges, opening up the pharmacy sector to competition, and a single effective price on carbon – are due to be revised and updated.

Potential interest rate rises in 2022

The RBA’s monetary policy has kept interest rates at record low levels – with the cash rate currently at 0.1%. This has arguably created a confidence that has pushed investors into riskier investments and artificially inflated stock prices and real estate. The lower rates have also punished savers who wanted to park money for a return with minimal risk.

Seven Group Holdings’ CEO Ryan Stokes said recently that the low-inflation environment a generation of investors has got used to, is on its way out.

During the COVID-19 pandemic, the RBA injected money into the economy, through the purchase of government bonds, a practice known as quantitative easing. At its February 1, 2022, meeting, the RBA announced it would stop pursuing this strategy by February 10, 2022. This means a rise in interest rates could occur in the not-too-distant future.

However, as mentioned earlier, the RBA makes the point that we’ll need to see wages growth above 3.0 per cent before there’s any substantial rise in interest rates.

How the Australian dollar is trending and its effects on the economy

Economists have had to grapple with one challenge: the Australian dollar (AUD) has barely reacted to the broad price surge in energy commodities over the past six months. Will this continue?

The medium-term forecasts for the AUD have been downgraded, as local economists expect the US Federal Reserve to raise interest rates well before the RBA.

The Australian Financial Review’s quarterly survey of 29 economists predicts the AUD will appreciate to merely US73¢ by June 2022, slightly down from US74¢ expected in the September 2021 quarter survey.

This affects the economy as higher interest rates increase the value of the AUD. Assuming the AUD appreciates (ie, the exchange rate increases), the relative price of domestic goods and services will increase. At the same time, the relative cost of foreign goods and services will fall. Economically, as we export more relative to imports, our net exports increase, and our terms of trade will be higher.

How these factors have impacted business and consumer confidence

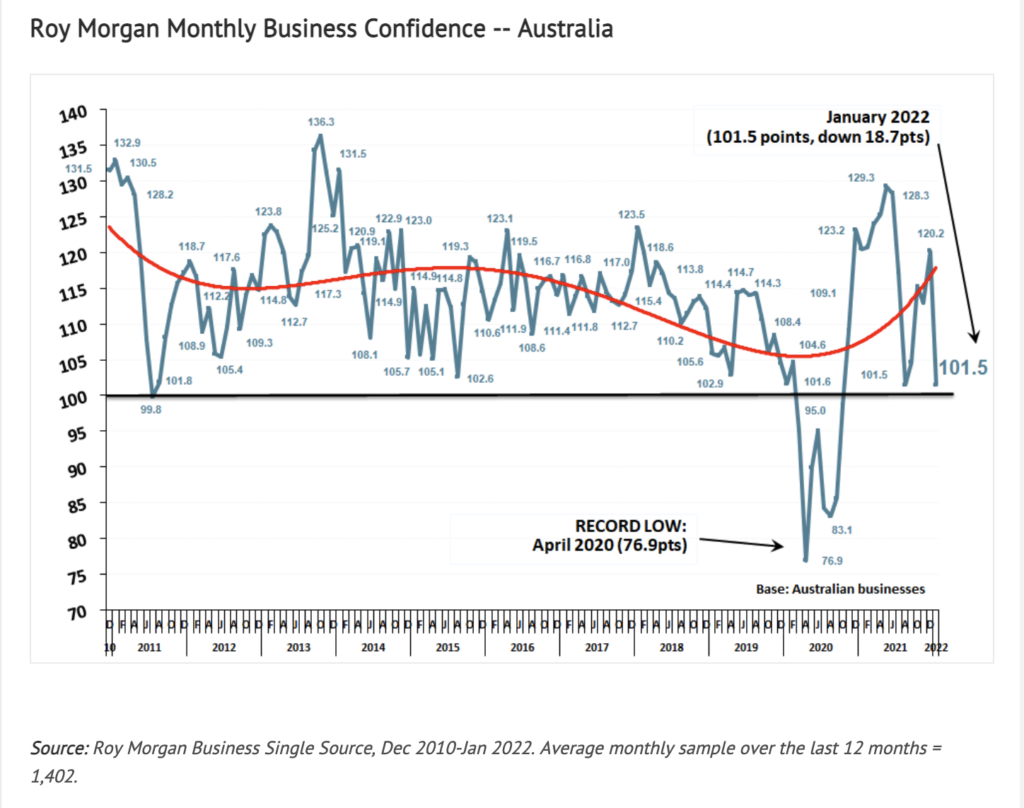

The Roy Morgan Business Confidence survey reported that Australian businesses were mainly pessimistic about future economic conditions plunging by 18.7pts (-15.6%) to 101.5 in January 2022.

A survey conducted by ANZ and Roy Morgan shows a similar trend was observed in consumer sentiment. With a sharp drop of 7.6 per cent in consumer confidence in early January 2022 down to 97.9, representing its lowest level since October 2020.

In New South Wales and Victoria, extended COVID-19 lockdown periods contributed to a sharp decline in business confidence in the first quarter of 2021-22, as State Government restrictions curtailed business operations. However, business confidence is expected to recover strongly over the remainder of FY 2022, as lockdowns in most States end.

As COVID stimulus packages recede, the Australian economy has demonstrated robust domestic growth. There’s further optimism in the suggestion from business leaders that the supply chain issues will soon pass. So, while some inflation is inevitable, it is predicted to be manageable.

Microeconomic issues affecting the Australian Steel Institute. A conversation with ASI’s Chief Executive, Mark Cain.

The Australian Steel Institute (ASI) is Australia’s peak body representing the entire steel supply chain from the manufacturing mills through to the end-users in building and construction, heavy engineering and manufacturing. Many ASI members are small to mid-sized businesses.

Banjo caught up with ASI Chief Executive Mark Cain, to hear first-hand how the current economic environment impacts the small to mid-sized steel businesses among its members.

1.How does high inflation impact the Australian steel industry?

Currently, global steel prices are at extremely high levels, and this, combined with long lead times, is causing some consternation for our members.

For example, roofing sheets needed for residential buildings usually have a lead time of 1-2 weeks. There are examples where this has blown out to 12 weeks! These new lead times have put pressure on our members, as they’ve found it difficult to source materials and schedule their work accordingly. In addition, this long lead time forces businesses to purchase enough materials to try and get ahead, which may put pressure on their working capital.

Members are also feeling the effects of the skilled labour shortage, putting pressure on wages.

Overall, the industry is performing well despite these microeconomic challenges. Infrastructure spending and building are strong across the country, so steel is in high demand, including in rural Australia where the drought has broken.

This is allowing some business owners to consider investing to meet this demand. Some are looking for short-term financing to help fund their expanded capability and to finance capital equipment.

2. How are businesses in this sector navigating these challenges in the short and long term?

We’re encouraging project managers to work with their supply chain to give plenty of notice of their requirements. This allows businesses to plan and meet their demands and helps to give confidence that the supply chain can deliver.

But if orders are left to the last minute, assuming that steel supplies are yet to come, businesses could be disappointed.

3. Is the speculation of the value of the Australian dollar impacting export/ imports, and if so, to what extent?

Many governments coming out of the pandemic are priming their economies through infrastructure spending. We’ve found that global demand has been strong, limiting the surplus capacity available to import steel into Australia.

When the Australian dollar is higher to the US dollar and steel is traded internationally in US dollars, imported steel would be more affordable. However, steel needs to be available.

4. What other challenges are ASI members facing in the current environment, and how are they overcoming them?

As I mentioned before, the availability of skilled labour is a big challenge ASI members are facing. ASI is engaging with various governments across the country to discuss how to tackle this problem.

Discussions range from strategies to solve the lack of skilled immigration, to the development of training schemes. ASI is also working on initiatives to attract local workers to the industry. We’re running a range of promotional activities to make the steel industry even more appealing to domestic candidates. Some of the activities involve ASI members talking to high school students, and outlining the vocational opportunities available in the steel industry.