The pandemic continues to challenge the supply chain in ways we didn’t expect. The Omicron variant has resulted in large numbers of staff being required to self-isolate either because of their own, or a family member’s infection. This scene has played out around the globe and has ultimately caused major disruption to freight and warehouse logistics. With downstream adverse effects on the supply of inventory to businesses, staff shortages have also caused disruptions to cash flow in the hospitality, leisure and gym sectors.

“The economic impacts of this near-global shut down because of the pandemic have thrust supply chain into the public realm in a way we have never seen before,” says David Paulson, global vice president at Avnet Inc in this edition of the Supply Chain Navigator.

Many businesses have been and will continue to be affected by these concerns – but don’t despair. There are strategies you can use to make sure your business stays in good shape. More on this later.

Disrupted Forces - Supply chain impacting businesses

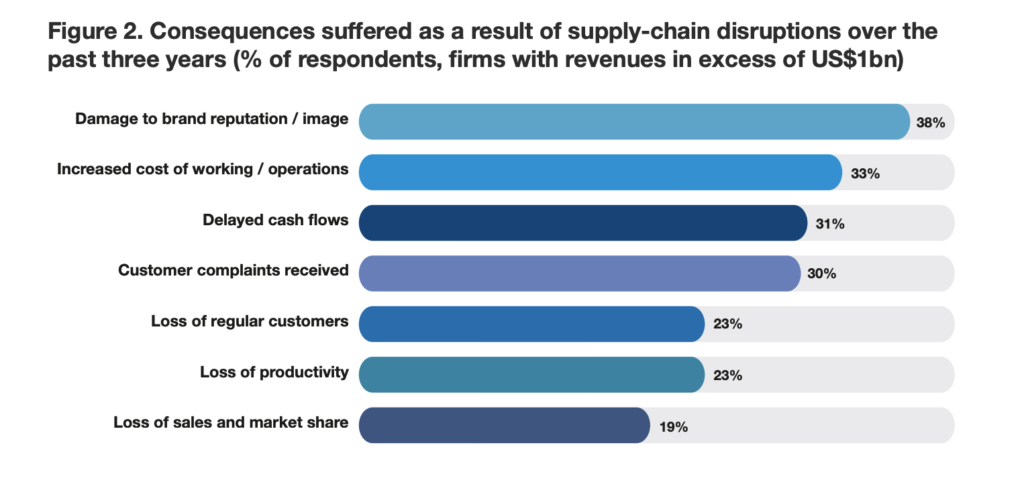

According to this report from The Economist, businesses have incurred substantial financial costs (averaging 6-10% of annual revenues) and reputational costs in terms of customer complaints and damage to brand reputation.

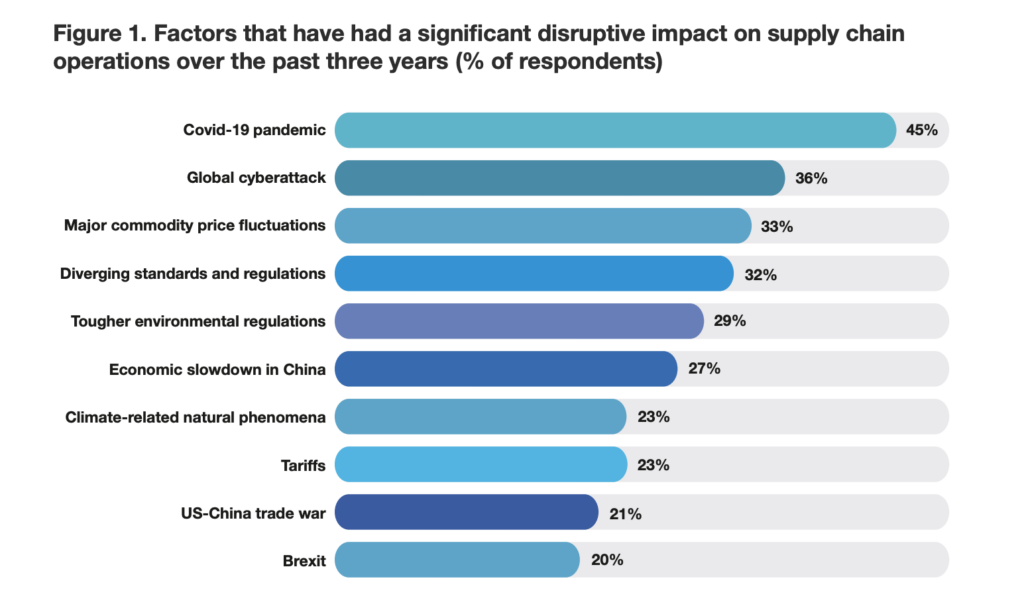

Image source: The Business Costs of Supply Chain Disruption

It’s likely that these impacts to businesses will continue to be felt for much of 2022 and possibly beyond. These include:

- Increased insurance costs - The role of insurance as a risk management solution can help in reducing the cost of supply chain disruption.

- Increased freight costs - Soaring demand for physical goods has increased congestion and delays at the world's ports and pushed up shipping costs. *

- Increased storage costs – With some businesses ordering stock 18 months to two years in advance, the demand for storage will increase. **

Image source: The Business Costs of Supply Chain Disruption

How to offset the negative impacts the supply chain is having on businesses

Businesses that take a range of actions to mitigate the impacts of future disruptions can turn the adverse effects into something positive.

Some strategies businesses can implement include:

- strengthening relationships with existing customers, suppliers and other stakeholders. It is easier to maintain existing relationships v’s building new ones

- improving supply-chain risk-management processes e.g. insurance

- diversify by investing in technology or new products to broaden your market appeal.

Another strategy for businesses to recover is to extract cash and cost from the supply chain by changing the supply chain cost structure and working capital profile. This can be done by focusing on inventory rationalisation, procurement spend reduction, logistics and warehouse optimisation, and manufacturing productivity as explained in this survey by Ernst & Young LLP.

Although it’s an issue that’s not going to go away any time soon, the risks to your business of supply chain difficulties can always be lessened. Start by talking to your trusted accountant or adviser. Banjo is here to help, whether it’s a chat with one of our experienced credit assessment team members to talk through potential solutions, or an injection of funds to help get over this period, you can always reach us on 1300 22 65 65.

* Lannin, Sue. “Shipping cost surge raises retail price pressures and inflation risks.”10, June. 2021. https://www.abc.net.au/news/2021-06-10/prices-consumers-shipping-ports-trade/100203086

** Walh, Liam. “'Supply worsening': 99 Bikes warns on global snags.” Financial Review. 3, jan, 2021. https://www.afr.com/companies/healthcare-and-fitness/supply-worsening-99-bikes-warns-on-global-snags-20201223-p56prh