Many SMEs didn’t need a crystal ball to predict that inflation was coming, and are using different strategies to manage it, according to Banjo’s recent SME Business Compass report.

With inflation now running at 5.1%, a reversal of the deflationary environment we’ve been in for the last few years has been looming on the horizon for some time.

In response, the RBA raised interest rates from 0.10% to 0.35% in May for the first time since November 2010, and many mortgage holders are no doubt starting to feel the pinch as the banks follow suit.

According to the Australian Financial Review, the Reserve Bank has ratcheted up its central forecast for headline inflation this year to about 6 per cent, although it expects this will ebb to around 3 per cent by 2024.

The National Australia Bank has been quoted as saying it expects the Reserve Bank to lift the cash rate to 1.25 per cent by the end of the year, and that it will peak at 2.5 per cent by 2024.

Before we feel too sorry for ourselves, this situation is not unique to Australia. According to Trading Economics, our inflation rate is currently lower than many first world economies, including the US (8.5%), UK (7%), Germany (7.4%) and New Zealand (6.9%). The US Federal Reserve has been hiking up interest rates since March this year, and the Bank of England has been doing so since late 2021.

The global reasons for these inflationary pressures include the pandemic, and lately, the war in Ukraine. These twin demons have, among other things, severely disrupted the supply chain and put oil prices into the stratosphere. From a local perspective, the early autumn floods were also a contributing factor.

As noted above, many SME owners have seen this coming. At the time Banjo surveyed businesses in February and March this year, over half (55%) were concerned that inflation will be a barrier to growth within the coming year. To mitigate the impacts of inflation, the broad spectrum of businesses surveyed are responding by increasing prices (42%) or reducing supply costs (37%).

However, it’s interesting to drill down into the some of the different sectors. Businesses in the retail industry (70%) are the most concerned about inflation, higher than the overall market (55%).

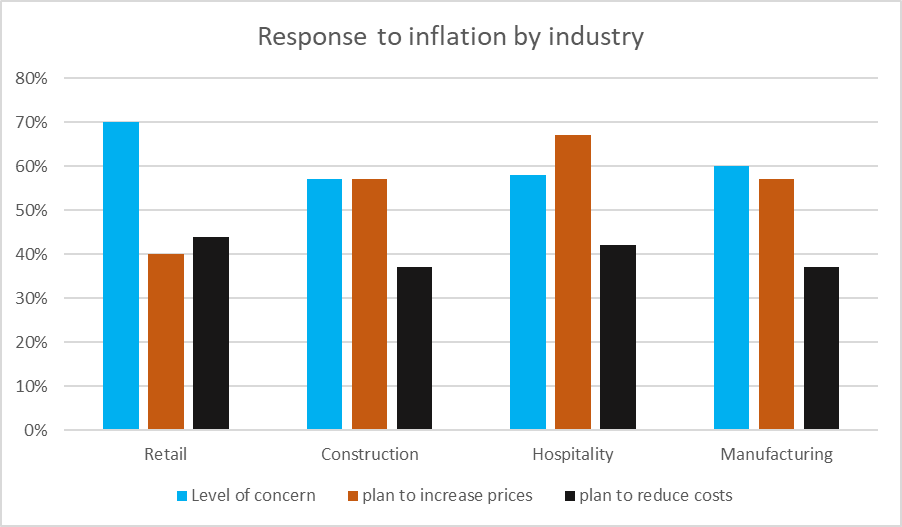

The anxiety level varies by industry, as do the plans for mitigating the effects of inflation. Looking at four key SME industries that have been hard-hit by the pandemic – retail, hospitality, construction and manufacturing – there were some marked differences (see graph below).

The highest level of concern was felt by SMEs in retail, who also felt the least able to increase prices, but most likely of the four to cut costs.

Hospitality SMEs were most likely to increase prices (68%) than the other 3, and also compared to the wider market, 42% of whom were prepared to raise prices.

Construction and Manufacturing were roughly on par in terms of their inclination to raise prices and lower costs.

While consumers in some sectors can be more price-sensitive than others, in a period of high inflation, many businesses can’t afford to sacrifice margin in the face of rising costs. Talk to your accountant, bookkeeper or lender about how your business can best meet the challenge of the current inflation environment.