SMEs have evolved and pivoted to stay competitive despite the uncertainty and challenges of 2021. Many have embraced the ever-changing retail environment by investing in new markets and technologies, launching new products, and revisiting their strategy.

According to Business Insider Australia, Australian shoppers are gearing up to spend $11 billion on Christmas gifts. SMEs investing in their growth early on will come out on top during what may be one of the busiest retail periods we have seen in a long time. It is worth noting that this consumer demand is also reflected in the international market. The hope is that as the economy picks up momentum, it will rebound once businesses reopen in line with the states’ roadmaps.

Four reasons why retailers might consider funding for this festive season.

Reason 1: Increasing your headcount

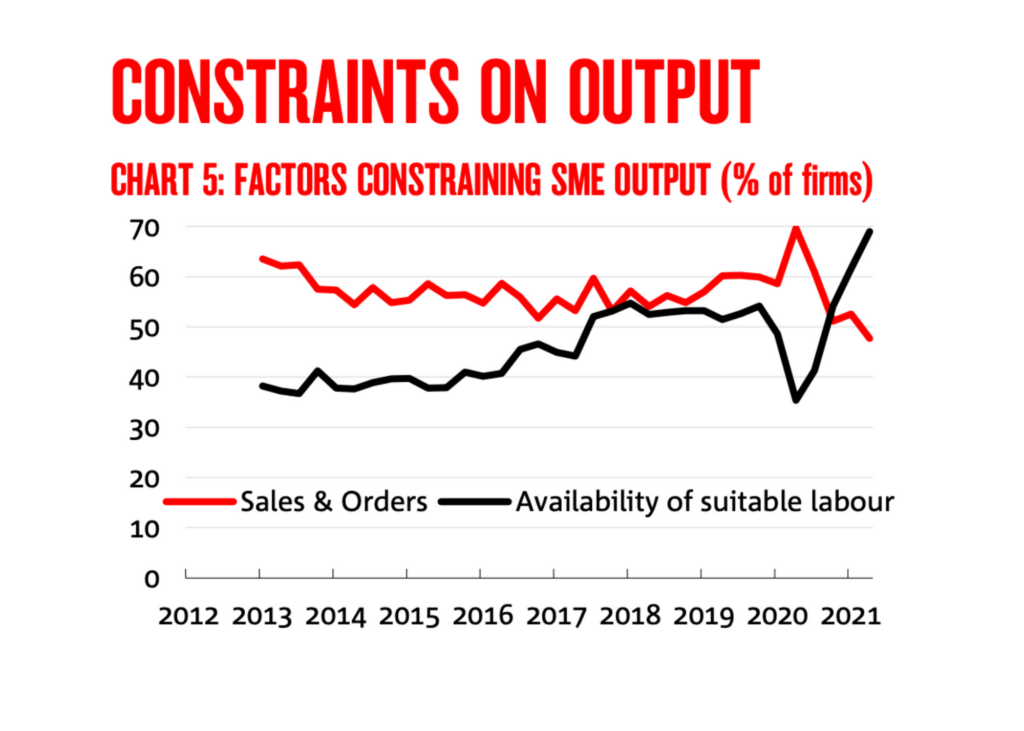

With unemployment at its lowest since 2010* and the high cost of labour, expanding your team now may put your business’ shopfront and online presence in a stronger position during the festive season.

The predictions are that revenue will hit record levels in the December quarter. Retailers may also be forced to increase their headcount to keep up with customers’ demands for faster delivery options and safer, more efficient in-store experiences.

Don’t miss out on a much-needed sale. Increasing staff members can support your business. It can do this by offering a more personalised, convenient, and frictionless experience that your customers are looking to mimic at home and in-store.

Reason 2: Due to logistical delays you may need to order additional stock to avoid losing sales

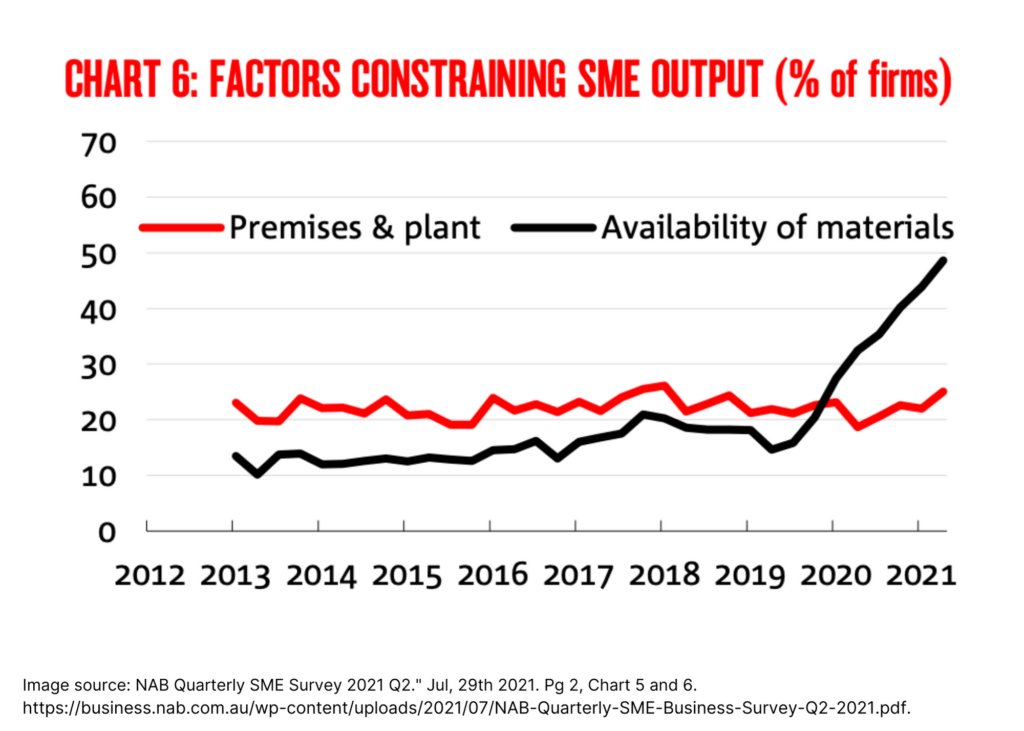

For the first time, the availability of materials is a larger issue than sales and orders.** With the pandemic still heavily impacting supply chains, sourcing stock and materials continue to be challenging. Supply shortages and distribution delays have been widely reported, and these are expected to last through the holidays and well into next year.

Even as the economy fully reopens and returns to some form of normality, supply chains will continue to be impacted by backlogs and increased demand. This could continue to mean you experience issues with inconsistent supply and other costs, such as warehousing and transportation. Therefore, to make sure your business keeps up with the increased demand this holiday season, you may need more additional stock upfront this year.

Reason 3: Increasing your marketing spend to stay competitive

As the demand for online and instore increases, so will the push on your marketing budget. How are you planning to stand out from the crowd, ensuring your business’ physical shop front and online store are the first choice for customers looking to buy now? Increased awareness will be the key in generating growth, which retailers desperately need these holidays to combat the revenue lost due to lockdowns.

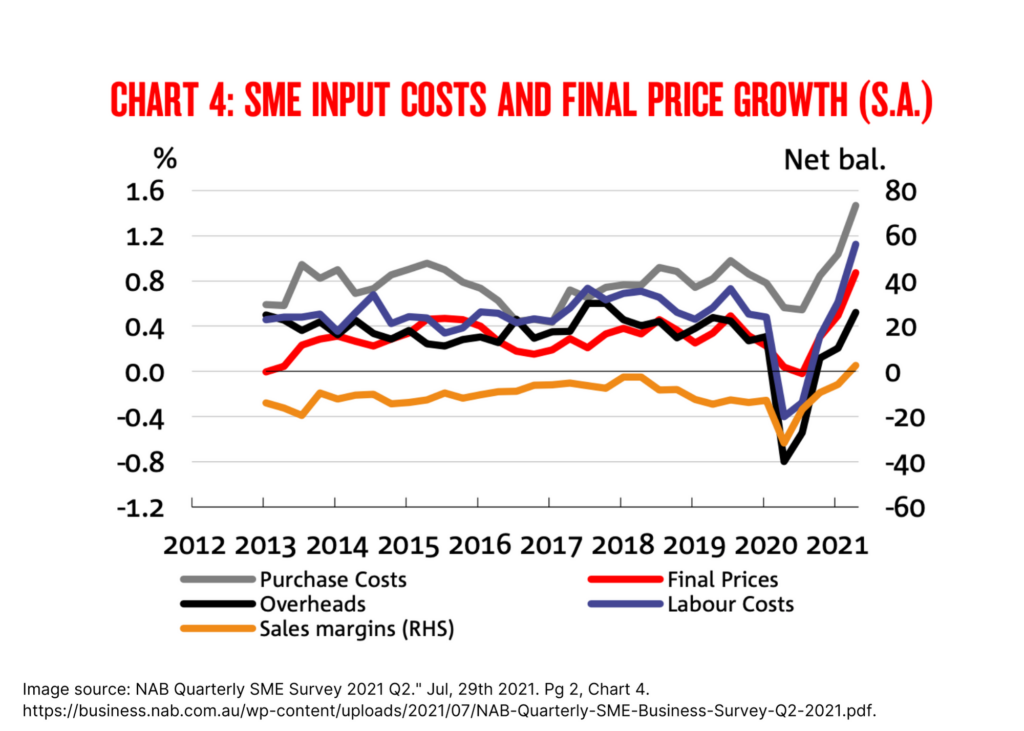

Margins remain tight due to increased expenses. However, this means that retailers do not have to go on sale earlier to sell down their stock. Resulting in business’ relying on amplifying their brand awareness. Examples include increasing your advertising budget across paid ads in Google, social media and even giving a little boost to your affiliate marketing. You may also like to boost your sales by offline retail tactics such as mailbox drops and radio advertising.

Reason 4: Improve and manage your cashflow during the peaks and troughs this festive season

Christmas can be one of the busiest sale periods for your business. It’s also the period where your retail business may find it the most challenging. This is due to the decline in sales after Boxing Day up until February. Funding can help to alleviate stress and assist you with executing and running a more successful Christmas campaign without worrying about your cash flow.

The retailers we deal with that have innovated and capitalised on new and evolving trends. As well as delighting and pleasing their customers, are the retailers likely to get through these peaks and troughs this festive season.

Are you looking for quick decisions and want to talk to someone who genuinely cares about powering your growth? Get in touch today with one of our highly experienced and friendly credit assessment team members on 1300 226 565.

*Gray, David. "Vital Signs: 4.6% unemployment rate hints at what’s possible, but it’s not the real thing." The Conversation, Aug, 19th 2021. https://indaily.com.au/news/business/2021/08/23/the-record-low-unemployment-rate-hints-at-whats-possible-but-its-not-the-real-thing/.

** "NAB Quarterly SME Survey 2021 Q2." Jul, 29th 2021. https://business.nab.com.au/wp-content/uploads/2021/07/NAB-Quarterly-SME-Business-Survey-Q2-2021.pdf.