There is a lot that had happened in the last seven months when we brought you our Economic Outlook Webinar. Banjo once again partnered with David Robertson, Head Economist from Bendigo Bank, and Patrick Coghlan, CEO of CreditorWatch, to bring you this session. This interactive and timely webinar highlighted the current state of the economy locally and globally and its impact on Australian businesses and households.

Despite going through one of the most significant shocks to the global economy, even worse than the GFC, Australia's GDP fully recovered. However, we are now facing a W shaped recovery of the economy.

Hopefully, this means that 2022 will be a robust recovery period, despite the setbacks in Sydney and Melbourne. Also, putting aside the shared optimistic forecast for next year, it will be interesting to see how the economy responds to the $311 billion worth of stimulus in place from the Federal Government.

Some of the topics discussed included:

- supply chain bottlenecks and increased freight costs

- monetary and fiscal support

- interest rates and the property market.

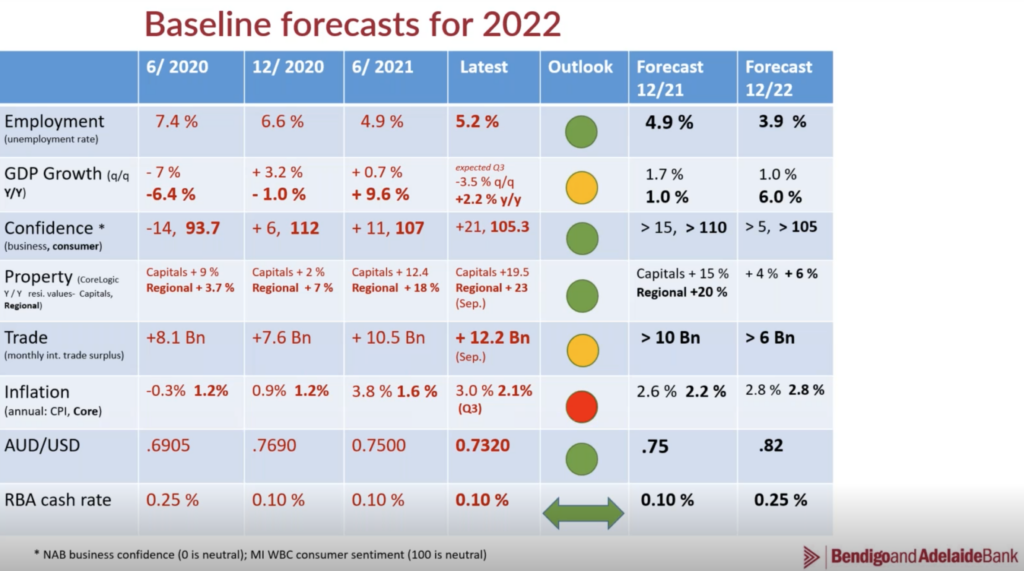

Before giving you a little taste of each topic below, here's an interesting chart that looks at the baseline forecasts for 2022.

The baseline chart above illustrates that the unemployment rate will fall aggressively in 2022, leading to strong employment growth. The outlook for a strong GDP for 2022 (increasing to 6%) is due to the reopening of the economy and Australia's high vaccination rates. In addition, Australia's confidence levels have been resilient throughout the year. It's also worth noting that the one area highlighted in red is inflation which David covers below.

Ten predictions for 2022

Below are ten predictions for 2022 presented in the webinar by David.

1. Chinese economy decelerating but can manage a soft landing

2. COVID vaccines the key driver of the global recovery - EU well placed

3. Geopolitical tensions to bubble away- but 'don't bet against the USA'

4. Global reflation underway- technology explosion and infrastructure binge

5. Stock markets supported by low 'risk-free rates', but inflation and ESG focus to grow.

6. Australian economy to grow around 6 % in '22; regional economies outperforming

7. National unemployment rate to trend down to 4 % in 2022

8. Aussie Dollar eventually back above 80 c (holding above 71 c)

9. Property to remain in demand but RBA rate hikes to impact in FY23

10. Commodity prices to remain elevated, exports to hold up resiliently.

Inflation, stocks and property

It's been the perfect storm for high inflation around the world. With sharp rises to core inflation due to the high cost of energy, import costs and oil. How will Australia respond to these global pressures? David suggests there will be gentle increases in interest rates in late 2022 which will gradually get to 1% in early 2023.

The out performances of regional compared to capital cities is a trend that will not change soon. In regional areas, property prices are up close to 25% in 12 months, and David explains that regional will continue to outperform capital cities. Another challenge is the rise of fixed interest rates.

With solid recoveries in the US, Australia ASX200 (our main index) went from 6000 a few years ago to 7,500. Compared to the US, where the NASDAQ has grown from 16 points to 16,000 points! Australia has lagged due to a lack of innovation, something that needs to be improved.

Customer sentiment continues to be strong into 2022. However, how other states will localise their outbreaks once borders open to NSW and Victoria will be challenging. Business confidence will become strong at the end of the year, and business investment will pick up.

We hope you enjoyed reading this small snapshot of the key takeaways from Banjo's Economic Outlook Webinar. If you are interested in hearing the entire webinar, feel free to drop us an email at info@banjoloans.com Also, don't forget to follow Banjo's LinkedIn company page for updates on our future webinars.