Whether it’s inflation, property values, employment levels, new car sales or copper prices, there are as many recession 'tipping points' as there are commentators on the subject. The economists’ jury is still out on the likelihood of Australia entering a full-blown recession, but the chatter is getting louder.

The traditional definition of a recession is two consecutive quarters of negative real GDP growth. But others, such as independent economist Saul Eslake, define it as a period in which unemployment rises by 1½ percentage points or more, in 12 months or less, and then until it starts coming down.

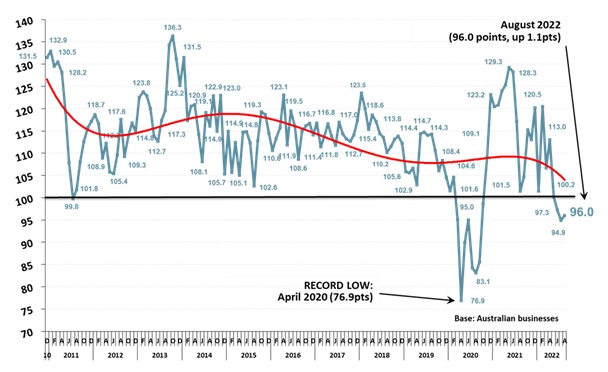

Currently, there are signs for and against an economic slump. In August 2022, the Roy Morgan Monthly Business Confidence indicator was 96.0 (up 1.1pts since July), the first monthly increase for four months since April 2022. This was the first rise in business confidence since the RBA began increasing interest rates in early May this year.

The August Roy Morgan index showed mixed results, with businesses saying they are concerned about the next year, and less likely to invest in growing the business in the next 12 months, yet more confident about longer-term prospects for the Australian economy. In short, businesses see some short-term pain ahead but are more upbeat about the longer-term horizon.

On the other hand, one of the indicators that economists and analysts watch is the price of copper, which is widely used in electronics, industry, transport, and renewable energy. According to the Sydney Morning Herald, the price of copper on the London Metal Exchange plunged by almost US$4000 a tonne between March and July this year. It has since risen by 10%, believed to be markets hedging their bets about whether a recession will be global or only in Europe.

There are several things that may buffer Australia against a recession, compared to other economies like the US, UK and New Zealand. Wage pressures haven’t yet made any material contribution to rising inflation, which should mean that the RBA doesn’t have to raise interest rates as aggressively as its counterparts in those and other countries. Our exports, especially energy products, are also strong.

Whichever way you define a recession, and whether this is a blip on the chart or a more sustained downward trend, it makes sense to ensure your business is as recession-proof as possible. Take a look at some of these strategies you can use to build in resilience before any downturn hits:

- One way to recession-proof your business is to invest in your existing clients. It’s considerably easier and cheaper to get repeat business from your existing customers, than the expense and effort it often takes to attract new ones. Your current client base knows your business, likes what you’re selling and trusts you. Nurture them with good service, exclusive deals and good communication. This may well lead to referral business at no advertising or other marketing cost to your business.

- Understand your financial position, and monitor your cash flow, outstanding invoices and sales on a day-to-day basis. Make sure your invoicing and accounts receivable operations are working efficiently. It seems an obvious thing to say, but the Banjo team have observed that many business owners get caught up in other areas of the business and forget to prioritise the financial fundamentals. Good advisers, such as your accountant, and a strong banking relationship can help guard against this.

- Make sure you have access to flexible working capital and emergency funds before you need it. Waiting until a recession hits to apply for the money you need, means that lending criteria may tighten, with credit and capital harder to get.

- Your suppliers and other stakeholders will be facing similar challenges to you. Talk to them about what impact they anticipate for their business, and vice versa, to help you plan for contingencies where supplies or sales are concerned. With sufficient market intel, you can order extra inventory if supply interruptions are likely or put in place incentives for customers to add value and keep them on side.

- Use borrowing to your advantage. A healthy unsecured loan amount that’s used to achieve specific growth plans and strategies for your business, can give your company the fuel it needs to grow. Work with your advisers to work out what size of loan you need and having a plan for it.

- Is there potential in your business for flexibility in staffing, such as a mix of permanent and labour hire employees? This could help you ride out any dips in demand and manage wage bills, yet be fully resourced when there’s an uptick in activity. Keep a weather eye on labour availability in your industry though.

The Australian economy train may be pulling into Recession Station soon, or it may speed past to Business-as-Usual Central. Either way, a bit of planning and preparation will make for a smoother journey for your business.

To pre plan your cash flow needs, check out our flexible range of solutions including Business Loan Flexi, Asset and Equipment Finance, Banjo Express and more to give you control and peace of mind in case of a recession.