Banjo was delighted to again host a webinar with Alan Oster, NAB’s Group Chief Economist, sharing his view of current economic conditions globally and at home.

His frank appraisal included some warnings about short term pain ahead, with a more positive medium-term outlook.

Watch the webinar here in full.

The global picture

First up, Alan warned that slow growth in most of the major economies has resulted in the lowest economic forecast (excluding COVID and GFC) since 2001. This has partly been fuelled by uncertainty about commodity prices due to the impact of the ongoing Russian/Ukraine war on, among other things, gas and wheat supplies.

On the positive side, China’s GDP is a bit better, growing from 3% last year to 5.5% now.

Japan, the UK and Europe have so far all narrowly avoided a recession. However, some countries like the USA and New Zealand appear to be heading toward one. A key factor in this is the financial lag from 12-18 months of interest rate rises, with lags usually taking at least 12 months to flow through.

Both NZ and the US went much harder on interest rate increases than Australia and some other nations. In NZ, a greater share of the market has fixed rate home loans, and those taken out 2 years ago are due to mature this year into a 6 or 7% variable rate.

Australia’s economy

Australia’s economy is relatively robust, and the RBA’s approach to interest rates has been gentler than the US or NZ, so Alan believes it’s unlikely we’ll experience a recession. However, he expects our economy to slow to near stalling speed by late 2023, with GDP predicted to fall to under 1% around that time. We should see it go back up to around 1.3% in 2024, and getting back to normal by 2025.

As identified in Banjo’s SME Compass 2023, inflation has been the biggest barrier to growth. Alan suspects we will hit peak inflation late this year, then get back in the 2-3% range by late 2024, possibly lower still by the end of 2025.

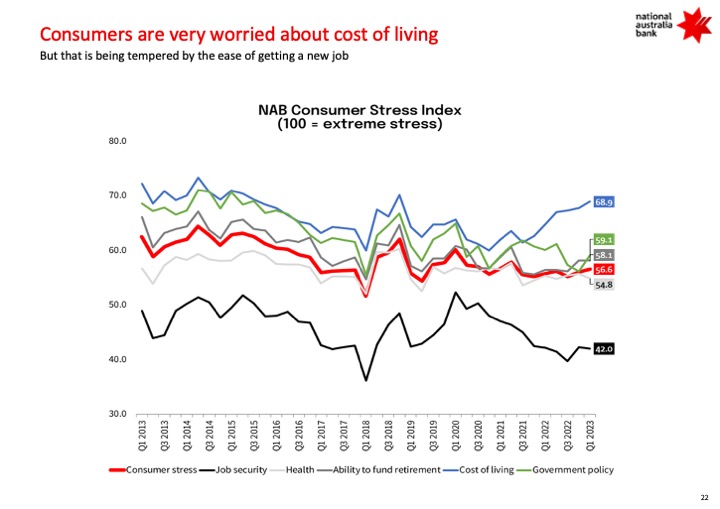

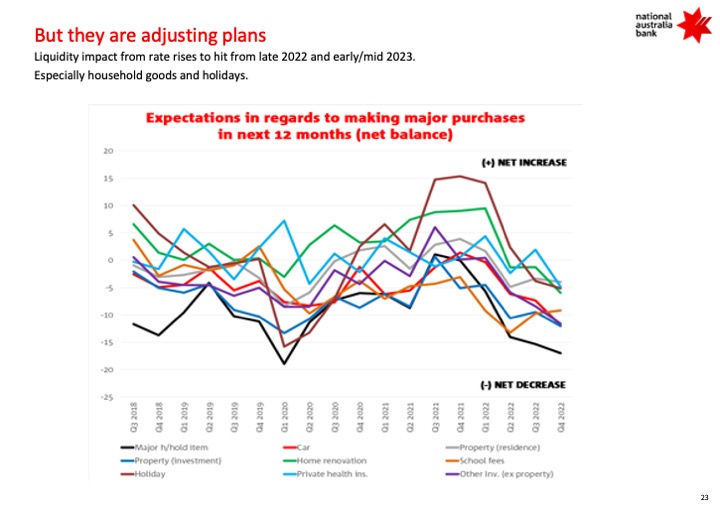

Inflation is the biggest consumer stressor at the moment, and Alan is more worried about Australian consumers’ spending behaviour than their liquidity. According to NAB’s transaction data, people are currently spending everything they’re earning. As the economic conditions bite, they’ll tighten their belts, which won’t sustain growth during the rest of 2023.

There’s also a sizeable swathe of fixed rate loans that were taken out 2 years ago, the maturity peak of which will be around June. House prices have probably bottomed out and will start to pick up, with a potential 5% increase in 2024.

There have been 400,000 new migrants to Australia in the last 12 months, which is higher than average, but is coming off the back of the COVID years when there were zero. Pre-COVID the average migrant intake was 200,000 annually. This level of migration will boost consumption as it flows through.

Business revenue and confidence

Having increased by 20% during the pandemic, purchase costs are still high but heading back towards normal levels.

Again in tune with SME Compass, Alan pointed out that businesses increased prices in the light of higher supply costs, successfully maintaining margin. While product prices have come back a long way, retail prices have yet to reflect that. However, competition will eventually drive prices lower.

Apart from mining, there are signs that business revenue is generally weakening, especially in the agriculture and transport sectors. The bright spots are services (especially administration and support), arts and recreation. Health and education are also picking up a bit.

Despite conditions for retail, wholesale and services such as hospitality being relatively good, business confidence has dipped in those sectors. They appear to have doubts that the current consumer spending levels will continue.

Business revenue and confidence

Having increased by 20% during the pandemic, purchase costs are still high but heading back towards normal levels.

Again in tune with SME Compass, Alan pointed out that businesses increased prices in the light of higher supply costs, successfully maintaining margin. While product prices have come back a long way, retail prices have yet to reflect that. However, competition will eventually drive prices lower.

Apart from mining, there are signs that business revenue is generally weakening, especially in the agriculture and transport sectors. The bright spots are services (especially administration and support), arts and recreation. Health and education are also picking up a bit.

Despite conditions for retail, wholesale and services such as hospitality being relatively good, business confidence has dipped in those sectors. They appear to have doubts that the current consumer spending levels will continue.

Asked which are the strongest growing industries in the medium term, Alan identified:

- Anything to do with the internet

- Security systems

- Public health and related high value manufacturing

The labour market

The record labour shortages are a big issue, with 90% of businesses saying they’re feeling the impact.

Wage growth is currently around 3.2% and will likely pick up a little to around 3.5%.

Unemployment is expected to increase from 3.5% to around 4% by year end, partly due to population growth. However, jobs will also continue to grow.

How business can prepare

To prepare for any potential downturn, Alan cited three measures businesses can take:

- Trim your costs

- Don’t add to your headcount unless you absolutely need to

- Talk to your bank if you have fixed rate loans maturing, or see difficulties on the horizon. They don’t want businesses to fall over, so will aim to help you.

In summary, Australia will take a few economic punches this year, but the bruising will subside as we move through 2024, and we’ll be back on form in 2025.