At Banjo, we understand that setting the right payment terms is one of the keys to great cash flow.

Katherine Hawes of Aquarius Lawyers says when it comes to putting in place the right payment term foundations for your business the first step is to look at your cash flow and budgets.

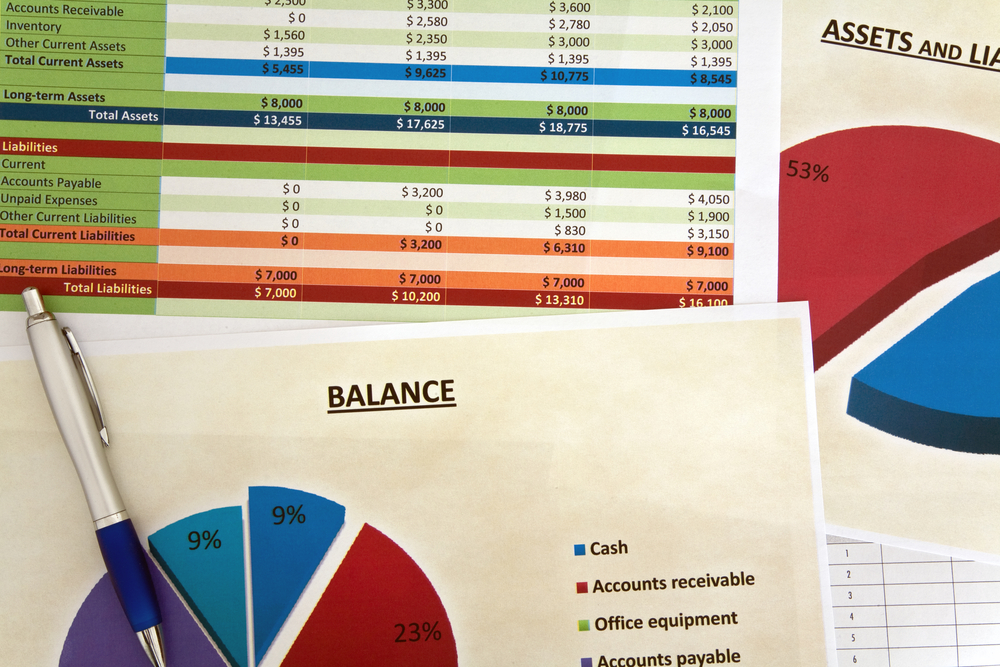

“It's important to review your cash flow statement and work out when you will have money going out to pay your own suppliers. Most companies tend to have standard 30-day payment terms. But as a service provider it is possible to ask for payment upfront or part payment,” advises Hawes.

Here are Katherine’s top tips for establishing and maintaining effective payment terms:

- If you’re invoicing the same company each month send invoices out on the same day. Invoices need to be sent out at least seven days before the actual payment is due to give the customer time to pay. This also allows your customers to budget for your invoice.

- When it comes to negotiating and communicating payment terms to customers, the best approach is to put together a standard form document customers sign before work starts. The document should include the scope of the work and what you may charge extra for. It also needs to include your payment terms and information on how you need to be paid, for instance credit card or cash only, as well as information about what will happen if you don't receive payment on time.

- The agreement, which should be signed by both parties before any work starts, should clearly state work will stop if payment is not made within the terms.

- To ensure customers pay your invoice on time, the best approach is to build good relationships with them in the first instance. Many invoice systems can send out payment reminders so make sure you set these up to remind your clients to pay you on time.

- Don' t be afraid to call up your customers a couple of days before the invoice is due to make sure they have all the information they need. This is good practice if the person who is paying the invoice is different from the customer you have been dealing with, which is often the case when working with larger companies.

- If you are struggling with cash flow, you may want to offer a small prompt payment discount, five per cent for example, for customers who pay their invoice early. There is also the option of charging a penalty fee for clients who continually pay late, but make sure this doesn't ruin your business relationship.

Says Hawes: “Be proactive rather than reactive and if your customer hasn't paid on time, get on the phone the same day and chase it up rather than doing nothing.”