Hello and welcome to Banjo Loans Deal of the month My name is Jason Gatt, and I’m the Partner Manager for VIC, WA and Tassie.

I’m excited to share this working capital loan deal with you. It’s for a major supplier and installer of motors for wind farming construction.

Based in Australia, the business is owned by a Denmark company who was then owned by other international firms. They have also been providing ongoing maintenance services for the entire windfarm cycle for almost two decades.

The business has a massive world-wide presence, currently servicing over 17 different countries. Established in 2004, this innovative company Established in 2004, this innovative company and currently has an annual turnover of $25 million.

Approaching Banjo Loans, this business required funding to develop new technology that would replace the usage of expensive cranes for their crane maintenance services arm. Instead of using expensive cranes to lift a Instead of using expensive cranes to lift a would enable them to push the motor into the air from underneath, reducing their largest expense and save between $2 to $3 million dollars a year.

This scenario along with the Australian entity being owned by several overseas firms led to a high level of complexity. The businesses finance broker needed a lender who could, firstly, provide the full loan amount and secondly could understand and be willing to work with the complex ownership structure.

Banjo’s approvals team has the expertise to drill into the ownership structure, and the broker took comfort that we could provide the full $1,000,000 dollar loan amount requested.

A 24-month working capital loan was funded quickly and they now can invest that money to result in the long-term efficiencies in its operations by saving $2-$3 million annually.

Thanks for watching, and if you have customers, you feel could benefit from a Banjo working capital loan, please do not hesitate to call me. Also, please keep an eye out for our soon to be released Asset Finance product.

For more please follow us on LinkedIn at Banjo Loans and subscribe to our YouTube channel.

Whether the predicted global recession reaches Australia or not, small business insolvencies and payment defaults have risen recently.

According to Equifax, SME insolvencies have increased over the past two years. This has happened more sharply in 2022, with 20% more insolvencies in June this year vs the same month in 2021. However, it’s worth pointing out that current insolvency levels are lower than those of 2019, immediately pre-COVID.

At the annual SME Big Breakfast in Melbourne recently, Banjo and CreditorWatch gave a joint presentation about how businesses can protect themselves from insolvency. The level of interest and discussion showed that this is currently a very hot topic. Here are some of the insights from that session.

CreditorWatch’s Business Risk Index (BRI) August 2022 data continues to show a clear trend of growing defaults in B2B trade payments. As the BRI data is mostly sourced from small and medium businesses, the signs give some cause for concern. According to CreditorWatch, among the pressures on SMEs are a 4.6 per cent increase in labour costs, and purchase costs up by 5.4 per cent. While businesses can pass these increases on to consumers at this stage, with overall product prices increasing by 2.7 per cent and retail prices by 3.3 per cent, how long this will prevail, is not clear.

According to CreditorWatch’s Geographic Business Risk Index, the areas currently experiencing greatest risk of SME default or insolvency are parts of Western Sydney (Canterbury, Green Valley, Merrylands), Jimboomba in south west Brisbane, and Surfer’s Paradise. More broadly around the nation, the industries most impacted are food and beverage, followed by arts and recreation.

A company is regarded as insolvent (from an accounting perspective) when it can’t pay its bills as they fall due, and when its liabilities are more than its assets. Among the factors that could push a business over the edge are: poor cash flow management, over-expenditure, or scarcity of staff.

Equifax points to an unfortunate reality that when a business is financially distressed, too often those running it resort to doing the wrong thing. Corporate liquidators report that 71% of all reported misconduct involved breaches of insolvent trading conditions. This being, despite signs being evident the companies in question were insolvent or becoming insolvent. It goes without saying that this only leads to more complex problems for the business, not to mention being illegal. Being alert to warning signs and taking appropriate steps to manage the situation can help avoid disasters.

During an economic slowdown, even well-run businesses can begin to struggle. For example, if a supplier of hard-to-get materials or one of your key customers becomes insolvent, this can have a knock-on effect on your business, through no fault of your own.

To protect your business, it’s critical that you’re willing to confront reality, and take responsible steps to mitigate the situation.

The red flags that could indicate your business is in trouble include:

Even if your business is going well, with no specific danger signs, there is the potential for greater contagion risk in this period of economic uncertainty. For example, one of your clients may be having difficulty getting payments from their customers, which could result in an inability to pay, or to supply to you. Keep a close eye on your network of suppliers and customers, and keep in touch with them. As far as possible, understand the nature of any financial risks facing their business which could indirectly impact yours.

Some of the steps you can take to protect your business include:

With business sentiment still relatively positive, consumer demand remaining high, and supply chain issues finally resolving, hopefully Australia will navigate around the recession storms.

Hi, and welcome to the Banjo Loans Deal of the month. My name is Brendan Widdowson and I’m the Head of Sales at Banjo.

Today, I will share a recent Working Capital Loan scenario in the retail or grocery sector. This client is an established business owner, who has set up and run several IGA supermarkets and hospitality venues in NSW.

The business had an opportunity to secure a lease and establish a brand-new IGA supermarket. The newly leased land is in an up-and-coming suburb in Queensland, surrounded by several housing developments that require a local supermarket.

The client funded the fit-out of the new premises with working capital from the business, however, required additional funding to purchase stock and other equipment. A referral partner sought out Banjo to assist with this, as they knew we would be an ideal lender for this client.

Despite establishing a new business, the client was eligible for a Banjo loan as they have been successfully running the existing businesses for the past 4 years, with an annual turnover of $1.8M. Due to the business owners’ other ventures performing well, Banjo’s credit assessors recognized the strong financials and ability to repay the loan.

A $250,000 36-month Working Capital Loan was provided within 3 days of their application so the business could move forward with its new venture.

Thanks for watching. If you have any customers you feel could benefit from a Banjo working capital or asset finance loan, please do not hesitate to contact your local Business Development Manager from Banjo.

For more please follow us on LinkedIn at Banjo Loans and subscribe to our YouTube channel.

Whether it’s inflation, property values, employment levels, new car sales or copper prices, there are as many recession 'tipping points' as there are commentators on the subject. The economists’ jury is still out on the likelihood of Australia entering a full-blown recession, but the chatter is getting louder.

The traditional definition of a recession is two consecutive quarters of negative real GDP growth. But others, such as independent economist Saul Eslake, define it as a period in which unemployment rises by 1½ percentage points or more, in 12 months or less, and then until it starts coming down.

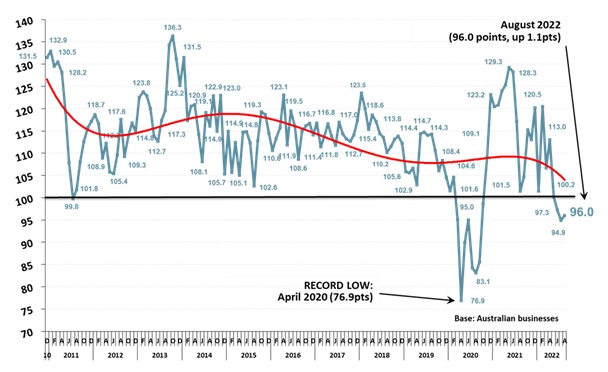

Currently, there are signs for and against an economic slump. In August 2022, the Roy Morgan Monthly Business Confidence indicator was 96.0 (up 1.1pts since July), the first monthly increase for four months since April 2022. This was the first rise in business confidence since the RBA began increasing interest rates in early May this year.

The August Roy Morgan index showed mixed results, with businesses saying they are concerned about the next year, and less likely to invest in growing the business in the next 12 months, yet more confident about longer-term prospects for the Australian economy. In short, businesses see some short-term pain ahead but are more upbeat about the longer-term horizon.

On the other hand, one of the indicators that economists and analysts watch is the price of copper, which is widely used in electronics, industry, transport, and renewable energy. According to the Sydney Morning Herald, the price of copper on the London Metal Exchange plunged by almost US$4000 a tonne between March and July this year. It has since risen by 10%, believed to be markets hedging their bets about whether a recession will be global or only in Europe.

There are several things that may buffer Australia against a recession, compared to other economies like the US, UK and New Zealand. Wage pressures haven’t yet made any material contribution to rising inflation, which should mean that the RBA doesn’t have to raise interest rates as aggressively as its counterparts in those and other countries. Our exports, especially energy products, are also strong.

Whichever way you define a recession, and whether this is a blip on the chart or a more sustained downward trend, it makes sense to ensure your business is as recession-proof as possible. Take a look at some of these strategies you can use to build in resilience before any downturn hits:

The Australian economy train may be pulling into Recession Station soon, or it may speed past to Business-as-Usual Central. Either way, a bit of planning and preparation will make for a smoother journey for your business.

To pre plan your cash flow needs, check out our flexible range of solutions including Business Loan Flexi, Asset and Equipment Finance, Banjo Express and more to give you control and peace of mind in case of a recession.

Hi, and welcome to Banjo Loans Deal of the month

My name is Nick Rogers, and I’m a Partner Manager for VIC and SA

This business is a privately-owned Australian retirement village development and management business. An established business in operation for almost 15 years and has an annual turnover of $16 million, it currently comprises of 404 completed and occupied independent living units.

Their growth goals aim to develop up to 1,110 units. In their plan, their vision is to provide residents with commercial and retail spaces, a 9-hole golf course, and related recreational facilities.

Historically, the retirement village achieved new settlements of 45-55 per year, however the flow on effects of COVID saw the settlements reduced to as little as 17 in FY22. This resulted in the cost to complete funding ratios to be exceeded, as well as delays in earth works and building.

The business approached Banjo for our short-term funding solution in order to pay out builders for outstanding claims, for assistance with the earthworks/construction supplier and to cover GST payments for the following 2 months.

Banjo’s credit assessors reviewed the credit factors and discovered that the directors had a strong commercial background in finance and were considered high integrity.

This business was also a leading retirement village in Australia and was highly profitable.

Due to these factors, Banjo assisted with a 2 to 6 month Single Pay (bridging finance) Loan of $1,000,000 within 4 days of application approval so the business could progress with its vision.

Thanks for watching, and if you have customers, you feel could benefit from a Banjo Working Capital Loan, please do not hesitate to your local Business Development Manager from Banjo. Likewise, please keep an eye out for our soon-to-be-released Asset Finance product.

For more please follow us on LinkedIn at Banjo Loans and subscribe to our YouTube channel.

Business Wrap - August 2022

Although we’ve had four RBA interest rate hikes this year that have taken the official cash rate to 1.85%, many consumers are yet to feel the full impact.

The last three rate rises (June, July and August) are only just starting to flow through to borrowers, as banks and other lenders pass on each successive rate with a sufficient notice period.

So while Aussies are quite subdued by the knowledge that cheap money has ended, many may not feel the cumulative effect on their wallets until around November.

Commonwealth Bank CEO Matt Comyn is also quoted as saying said the record low level of bad debts is a lagging indicator. Both are compelling reasons to avoid complacency and look to revisit your business forecasts.

Current predictions are that the RBA will continue to lift the cash rate to between 2.5 and 3% until inflation (currently at 6.1%) peaks at 7 to 8% later this year, then falls back to the top of the 2 to 3 per cent target range by some time in 2024.

This has been the fastest annual growth in inflation since 2001, forcing consumers to shell out more for everything from fuel to food. Fruit and vegetable prices rose almost 6% in the June quarter alone, prompted in part by shortages caused by heavy rains in areas of the east coast of Australia.

We haven’t seen inflation grow this fast since the introduction of the GST, so many small business owners haven’t experienced running their business in such an environment.

And while supply chains are beginning to normalise, rolling lockdowns in China can still have an impact. Some suppliers are favouring larger markets like the US, causing headaches for Aussie businesses that need to pivot to different sources. On the domestic front, services like Australia Post have announced price hikes, effective from early September.

These and other challenges can eat into profits and impact your business's viability. Let’s look at some tactics for mitigating them. This assumes you already know what your margins and operating costs are.

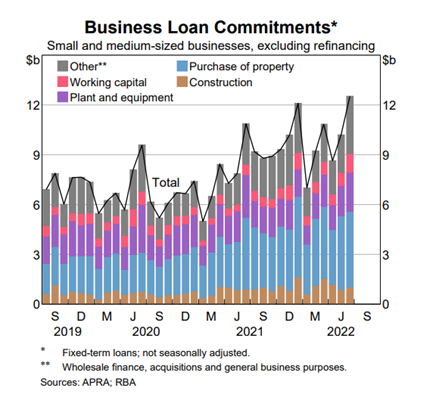

Strong cash flow is essential to help you manage the inflationary headwinds and continue investing in your business regardless of the tactics used. According to Xero, about one in five small businesses experience a cash flow crunch – where expenses exceed revenue – at least 50 per cent of the year. Business loans can help cut through that crunch with the cash you need to move forward, whether it’s managing your supply chain, investing in new assets or simply covering unexpected expenses.

With business loan interest rates rising, and residential property prices set to dip, you’d want to think long and hard before taking out a loan secured to your home or business property. Instead, explore the non-bank lending products out there, like Banjo's Working Capital Loan which is much more adaptable to the needs of smaller, high-growth businesses across a range of industries.

Hello, my name is Jason Gatt, and I’m the Partner Manger at Banjo Loans for VIC/WA and TAS.

I’m excited to share our deal of the month, in which Banjo repeatedly helped this structural and architectural steel fabrication business overcome cash flow issues and manage its working capital better.

In business for 15 years, this established company have a healthy $2 million per annum revenue turnover, providing support to residential, industrial, and commercial sectors, and met Banjo’s initial eligibility criteria.

The business required operating funds as it was suffering from growing pains, cost pressures due to inflation and lagging accounts receivable that were all having a negative impact on its working capital and cash flow.

Having only borrowed from Banjo for the first time a few short months earlier, Banjo was thrilled they approached us to assist again, having been satisfied with the experience and service they received with their first loan. As Banjo were already familiar with the business and their journey ahead, we were able to increase their funding facility, and provide additional funding to assist with their general working capital and purchasing of materials.

From Banjo’s side, this client had proved to be a quality and reliable enterprise to do business with, with on time repayments on their original loan, we had no hesitation to assist this client again with another loan and help move their business forward.

An original 12-month loan of $75,000 was approved and funded, and then the subsequent additional 12-month loan of $50,000 was provided. Both loan applications were approved and funded within 2 days of the application submission.

Thanks for watching, and if you have customers, you feel could benefit from a Banjo working capital loan, please do not hesitate to call me. Likewise please keep an eye out for our soon to be released Asset Finance product.

For more please follow us on LinkedIn at Banjo Loans.

Many SMEs didn’t need a crystal ball to predict that inflation was coming, and are using different strategies to manage it, according to Banjo’s recent SME Business Compass report.

With inflation now running at 5.1%, a reversal of the deflationary environment we’ve been in for the last few years has been looming on the horizon for some time.

In response, the RBA raised interest rates from 0.10% to 0.35% in May for the first time since November 2010, and many mortgage holders are no doubt starting to feel the pinch as the banks follow suit.

According to the Australian Financial Review, the Reserve Bank has ratcheted up its central forecast for headline inflation this year to about 6 per cent, although it expects this will ebb to around 3 per cent by 2024.

The National Australia Bank has been quoted as saying it expects the Reserve Bank to lift the cash rate to 1.25 per cent by the end of the year, and that it will peak at 2.5 per cent by 2024.

Before we feel too sorry for ourselves, this situation is not unique to Australia. According to Trading Economics, our inflation rate is currently lower than many first world economies, including the US (8.5%), UK (7%), Germany (7.4%) and New Zealand (6.9%). The US Federal Reserve has been hiking up interest rates since March this year, and the Bank of England has been doing so since late 2021.

The global reasons for these inflationary pressures include the pandemic, and lately, the war in Ukraine. These twin demons have, among other things, severely disrupted the supply chain and put oil prices into the stratosphere. From a local perspective, the early autumn floods were also a contributing factor.

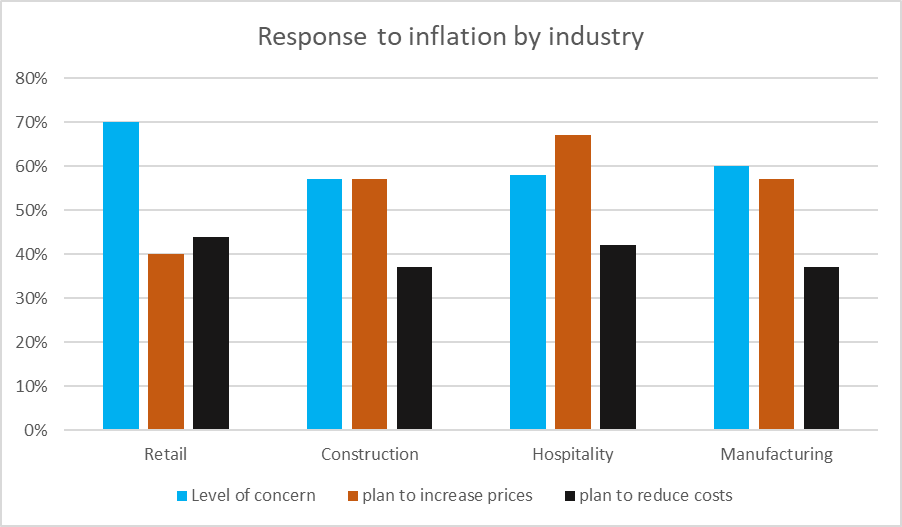

As noted above, many SME owners have seen this coming. At the time Banjo surveyed businesses in February and March this year, over half (55%) were concerned that inflation will be a barrier to growth within the coming year. To mitigate the impacts of inflation, the broad spectrum of businesses surveyed are responding by increasing prices (42%) or reducing supply costs (37%).

However, it’s interesting to drill down into the some of the different sectors. Businesses in the retail industry (70%) are the most concerned about inflation, higher than the overall market (55%).

The anxiety level varies by industry, as do the plans for mitigating the effects of inflation. Looking at four key SME industries that have been hard-hit by the pandemic – retail, hospitality, construction and manufacturing – there were some marked differences (see graph below).

The highest level of concern was felt by SMEs in retail, who also felt the least able to increase prices, but most likely of the four to cut costs.

Hospitality SMEs were most likely to increase prices (68%) than the other 3, and also compared to the wider market, 42% of whom were prepared to raise prices.

Construction and Manufacturing were roughly on par in terms of their inclination to raise prices and lower costs.

While consumers in some sectors can be more price-sensitive than others, in a period of high inflation, many businesses can’t afford to sacrifice margin in the face of rising costs. Talk to your accountant, bookkeeper or lender about how your business can best meet the challenge of the current inflation environment.

A strong theme is emerging from two consecutive years of Banjo’s annual SME Compass research among the leaders of over 500 SMEs* across Australia.

A substantial number of the SMEs surveyed increased investment in their businesses in response to the pandemic, and it seems to be paying off for them. The research found that the businesses that kept investing, and usually borrowing to invest, are consistently growing and meeting or exceeding their targets.

This seems to have contributed to the health of the sector post-COVID, with a lot more Australian SMEs (55%) achieving or exceeding their revenue targets in 2021 than the previous year (45%).

The biggest increases in investment were in new technology (61% in 2022 vs 51% 2021) and marketing (50% vs 41%). Acquiring real assets and moving all or part of the business online were also high up the list.

SMEs who invested in new technology, purchased new assets and increased headcount were most likely to achieve success by exceeding their revenue targets. Thirty per cent outperformed their targets in the last year, up from 25% the previous year.

This may be one of the key reasons Australian SMEs are coming out of two years of the pandemic with a positive outlook and a continued eagerness to invest in their business. With 69% expecting their revenue to grow over the next 12 months, and 83% confident about the future of their business, there’s high optimism for the year ahead.

Those who are anticipating growth say they’ll be investing in their business in 2022 by improving existing products, investing in new technology and spending more on marketing than last year.

Forty seven per cent of businesses are planning growth through acquisition – up from 42% in 2021. This year, a greater proportion of SMEs (45%) are using acquisitions to add value to customers by strategically enhancing their products’ “stickiness” compared to last year (33%). Acquisitions are also increasingly being viewed by respondents as a way to grow product offering, revenue and profitability.

Despite the upbeat outlook and strong progress, there are some roadblocks. Many SMEs are still frustrated by the traditional bank borrowing process.

A majority (62%) of SMEs continue to face challenges when trying to secure funding in this way. The glacial pace of traditional bank procedures was the main frustration in 2022. With 40% of SMEs turning to the major banks as their first funding option, this suggests many are not fully informed about the alternative faster and more efficient loan options available to them.

Sixty three per cent of SMEs intend to fund their growth in the coming year through loan facilities such as bank loans, founder investment and credit facilities. With secured business loans and term loans the most commonly used financial products, this suggests many are yet to understand that unsecured loans are a viable option.

Other challenges have certainly been faced in 2021 and early 2022, including supply chain issues and labour skill shortages. But it seems many businesses have used strategic measures, including further investment, to overcome these.

SMEs certainly rose to the challenges of the past year, and are displaying the optimism, business savvy and flexibility needed to help them navigate whatever 2022 throws at them

*the respondents were from a broad cross-section of businesses, none of whom were Banjo clients.