Business Wrap - August 2022

Although we’ve had four RBA interest rate hikes this year that have taken the official cash rate to 1.85%, many consumers are yet to feel the full impact.

The last three rate rises (June, July and August) are only just starting to flow through to borrowers, as banks and other lenders pass on each successive rate with a sufficient notice period.

So while Aussies are quite subdued by the knowledge that cheap money has ended, many may not feel the cumulative effect on their wallets until around November.

Commonwealth Bank CEO Matt Comyn is also quoted as saying said the record low level of bad debts is a lagging indicator. Both are compelling reasons to avoid complacency and look to revisit your business forecasts.

Current predictions are that the RBA will continue to lift the cash rate to between 2.5 and 3% until inflation (currently at 6.1%) peaks at 7 to 8% later this year, then falls back to the top of the 2 to 3 per cent target range by some time in 2024.

This has been the fastest annual growth in inflation since 2001, forcing consumers to shell out more for everything from fuel to food. Fruit and vegetable prices rose almost 6% in the June quarter alone, prompted in part by shortages caused by heavy rains in areas of the east coast of Australia.

We haven’t seen inflation grow this fast since the introduction of the GST, so many small business owners haven’t experienced running their business in such an environment.

And while supply chains are beginning to normalise, rolling lockdowns in China can still have an impact. Some suppliers are favouring larger markets like the US, causing headaches for Aussie businesses that need to pivot to different sources. On the domestic front, services like Australia Post have announced price hikes, effective from early September.

These and other challenges can eat into profits and impact your business's viability. Let’s look at some tactics for mitigating them. This assumes you already know what your margins and operating costs are.

- Increasing your prices is the obvious option, but the amount of increase depends on what your market will bear. Regular small price increases might be the way to go, rather than a large price hike. Try testing small and bigger increases on different products to see how your market responds. If you do increase prices, consider a value-add to keep customers on the side.

- Clear customer comms is essential when you introduce a price increase, as they’re more likely to be supportive and stay with you if they understand the reasons. Keep track of their feedback and watch your sales data.

- Look at cutting discretionary costs. Can you switch to alternative cheaper business functions or processes? Negotiate with suppliers or explore others who offer better deals.

- Consider being flexible with employee hours, by adjusting staffing to match times of high demand, and managing with less at times of low traffic. That said, hang on to good, effective employees and keep them motivated. Having to replace people in the current tight labour market is costly.

- Invest in technology that can streamline your business processes and improve efficiency. This could be developing a mobile app to make it easier for customers to order and pay from your business, or 3D printing to get around some supply disruptions. Also, look at downloading apps to help you run your business on the go. Many, such as Invoice by Wave (streamlines your invoices), Expensify (helps you quickly upload business expense receipts) or Thrive (helps you keep track of your small business data in real-time) are free from the App Store.

- Think about stocking up on inventory now to beat further price increases and get ahead of random supply chain disruptions at peak season.

- Keep investing in projects that will ultimately boost sales or improve productivity.

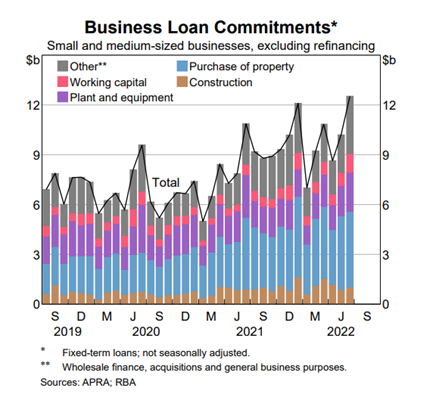

Strong cash flow is essential to help you manage the inflationary headwinds and continue investing in your business regardless of the tactics used. According to Xero, about one in five small businesses experience a cash flow crunch – where expenses exceed revenue – at least 50 per cent of the year. Business loans can help cut through that crunch with the cash you need to move forward, whether it’s managing your supply chain, investing in new assets or simply covering unexpected expenses.

With business loan interest rates rising, and residential property prices set to dip, you’d want to think long and hard before taking out a loan secured to your home or business property. Instead, explore the non-bank lending products out there, like Banjo's Working Capital Loan which is much more adaptable to the needs of smaller, high-growth businesses across a range of industries.