- From 1 July, Australian employers must pay superannuation with every pay run, not quarterly

- This tightens SME cash flow and increases payroll and compliance risk

- Brokers can add value by helping clients plan ahead, forecast cash flow, and review working capital early

A significant shift is coming for Australian SMEs: Superannuation Guarantee contributions will need to be made at the same time as wages, not quarterly. This legislative change, known as Payday Super, means business owners and their advisors need to rethink how they manage payroll, cash flow, and compliance.

What is Payday Super and what’s actually changing?

- Employers must pay superannuation guarantee contributions with every pay run, rather than quarterly.

- This change is designed to improve employee outcomes and financial discipline, but it also brings new cash flow and administrative challenges for SMEs.

Why Payday Super matters for brokers

Brokers are trusted partners for SMEs, especially when it comes to navigating financial change. With many business owners still unaware or unprepared for Payday Super, brokers have a unique opportunity to add value by helping clients plan ahead, avoid compliance pitfalls, and manage cash flow proactively.

Key impacts for SMEs

- Tighter Cash Flow: Paying super more frequently means less flexibility to manage cash reserves across the quarter. Businesses with seasonal or lumpy income may feel the pinch.

- Increased Admin: Payroll systems and processes will need updating. There’s a higher risk of non-compliance and penalties if businesses aren’t ready.

- Need for Oversight: SMEs will need to be across every revenue and expense item, with a sharper focus on debtor control and short-term expenses.

How brokers can start the Payday Super conversation

These questions can help to open a productive discussion about Payday Super and its impact with SME clients:

If the client hasn’t thought about Payday Super yet:

- “Are you aware that Super will need to be paid at the same time as wages from July?”

- “Would it help to walk through how that might affect your cash flow timing?”

If cash flow pressure is already a concern:

- “Do you expect tighter cash flow at certain points in the month once super is paid each pay run?”

- “Will your current working capital setup still be right under the new rules?”

These conversations can position you as a partner focused on planning and momentum, not simply funding.

Practical tools to support your clients

To help brokers and SMEs prepare for Payday Super, Banjo offers practical resources designed to support confident decision-making.

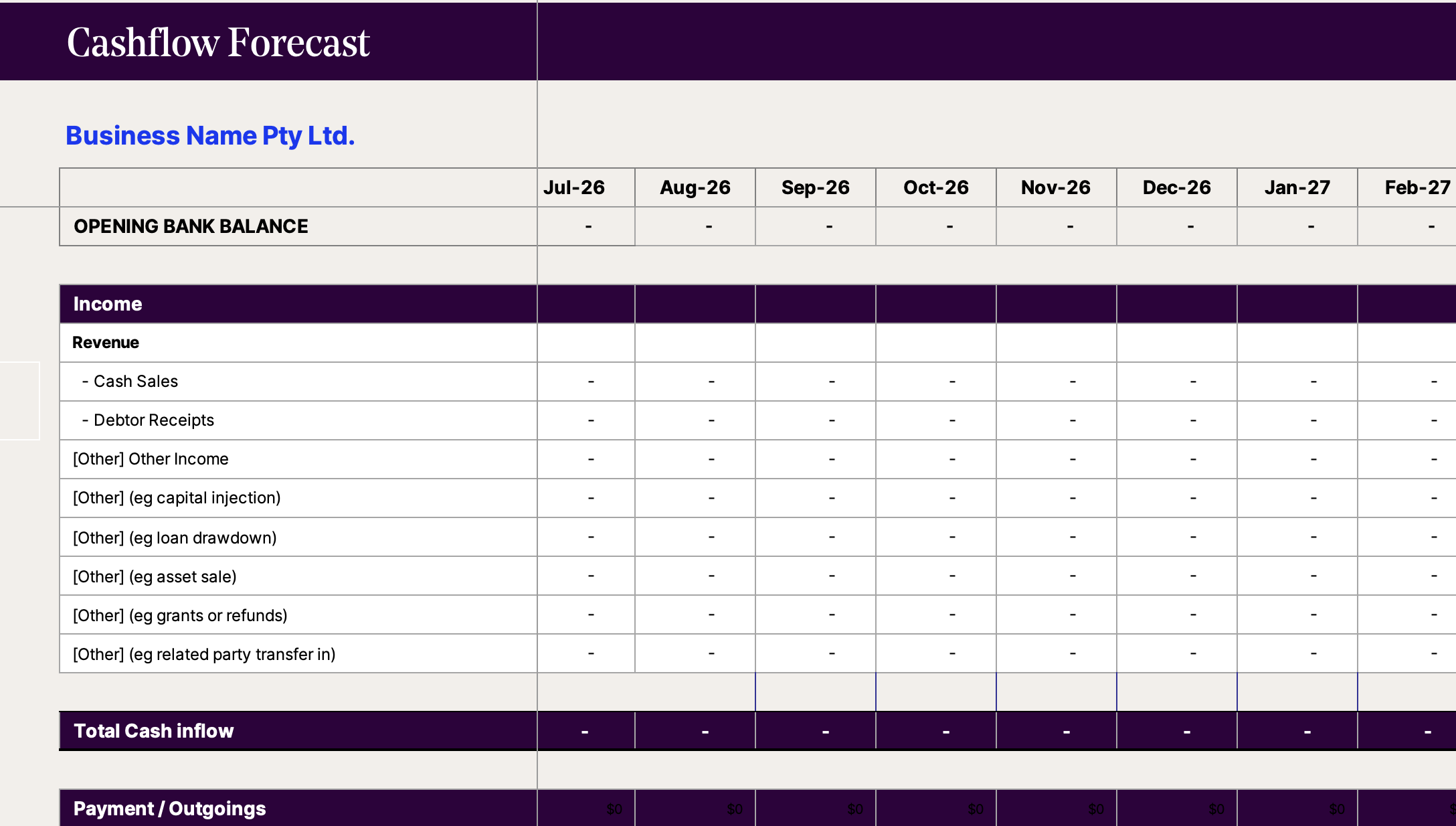

Cashflow Forecasting Tool:

Helps businesses model the impact of their cashflow, considering the new super considerations, so you and your clients can identify potential gaps and plan accordingly. Access the Cashflow Forecasting Tool

Download template

‘Is your business financially fit?’ eGuide:

A simple, practical guide to help SMEs assess their financial health and prepare for common cash flow challenges. Download the eGuide

Download eGuide

How Banjo can help if gaps emerge

If Payday Super creates short-term cash flow pressure, Banjo’s Express Business Loan can provide fast, flexible funding of up to $500k. Using bank statements and ATO history, successful applicants can receive conditional approval quickly, with funds available in as little as 24 to 48 hours*.

- ‘Is your business financially fit?’ eGuide:

A simple, practical guide to help SMEs assess their financial health and prepare for common cash flow challenges. Download the eGuide

Final tips for brokers

- Encourage clients to review their payroll and cash flow processes now, not later.

- Suggest they consult with their accountant, or bookkeeper to ensure compliance.

- Reinforce that being proactive is the best way to avoid penalties and keep their business moving forward.

Ready to move a deal forward?

Check out the Partner Hub or contact your BDM today.

* Disclaimer: All loans are subject to eligibility criteria and approval by Banjo. Fees, terms, and conditions apply. Director guarantees and other security may be required for some loans. Statements regarding timing, applications, approvals, and funding are indicative. Any advice given does not take into account the personal circumstances of any borrower, who should consider what products are appropriate for them and obtain professional advice where relevant.